CNBC's Jim Cramer said Tuesday that investors need to be on their toes as Wall Street trudges through a period of frequently reevaluating the Covid recovery.

Reaction to Home Depot's earnings report before the market open Tuesday demonstrates the need to be nimble, the "Mad Money" host said. "Don't get too complacent in your negativity."

Shares of the home improvement retailer closed down more than 4% even after the company beat analyst expectations on revenue and earnings. However, same-store sales slightly missed forecasts, and the company also said it recorded fewer customer visits to stores during the second quarter.

"In the end, Home Depot will be fine. ... The real issue is that the consumers sure picked an awful time to go back to travel and recreation," Cramer said. "The specter of the delta variant is making people reconsider all sorts of fun decisions, especially their vacation plans, which means the money that was initially supposed to go to Home Depot and then got shifted to travel might not get shifted to anything. ... It might not do anything."

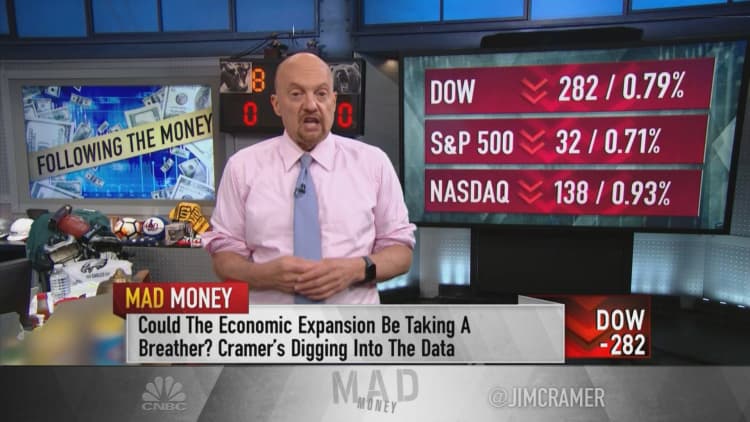

Combine worse-than-expected July retail sales with Home Depot's report, and Cramer said the result has rekindled investor concerns about waning U.S. consumer strength and coronavirus impact. That's partly why, he said, Covid vaccine makers Pfizer and Moderna saw their stocks jump Tuesday even as all three major equity indexes finished firmly in the red.

Cramer said he believes this seemingly day-to-day rotation in and out of pandemic winners represents "lazy thinking" from investors. Consider those who were selling Home Depot shares on Tuesday, he said.

"What happens if their arch-rival, Lowe's, whose stock was down big today, reports tomorrow and says it had none of those problems? What if Lowe's tells you the consumer is spending harder than ever?" Cramer said. "Honestly, it wouldn't shock me, because Marvin Ellison, the CEO of Lowe's, is fantastic at his job."

The "Mad Money" host said he recommends investors "pick at stocks that got hit as part of the collateral damage from this new, more negative worldview."

"The drug stocks, the real estate investment trusts and the foodstuffs, they're all going to work for a couple days. However, if we can catch a break, if the delta variant burns itself out — either because the unvaccinated get their shots or because everybody gets infected — then you're going to have to switch gears in a hurry," he said.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com