CNBC's Jim Cramer said Monday he believes beleaguered Chinese property developer Evergrande does not present a major risk to the U.S. economy and financial system.

"Evergrande's stock has been obliterated and that pain is spreading to the rest of the Chinese real estate industry, to the Chinese financial sector and to foreign banks with lots of China exposure," the "Mad Money" host said.

"Evergrande is definitely a systemic risk for China," Cramer added, "but I don't think that will do much damage here."

Cramer's comments came after a steep sell-off in the U.S. equity market, with the Dow Jones Industrial Average dropping 614 points, or 1.8%, on Monday. The S&P 500 and tech-heavy Nasdaq sank 1.7% and 2.2%, respectively.

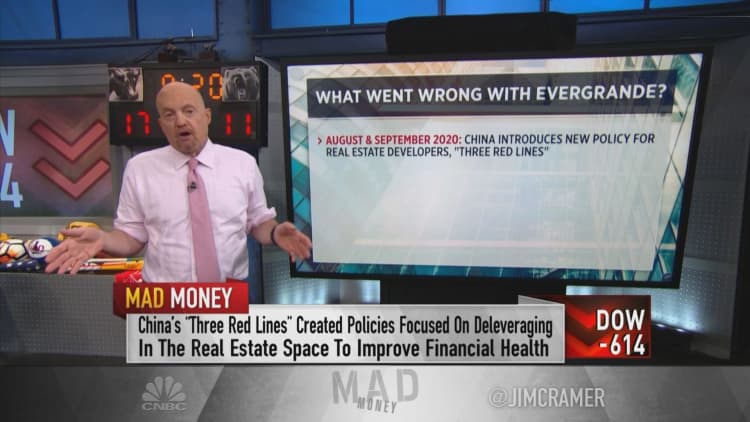

Concern about Evergrande defaulting on its sizable debts and the potential for financial contagion was one of the factors weighing on Wall Street on Monday. Despite Cramer not seeing broad U.S. economic risks, he said individual companies could certainly be impacted by Evergrande's woes.

"If Chinese real estate collapses, that's bad news for the metals and mining complex — witness the breakdown in Freeport-McMoRan," Cramer said, referring to the fact the Arizona-based company's shares dropped 5.7% Monday.

"Plus, if this causes a full-on recession in China, then U.S. businesses with lots of Chinese exposure could get hit there. You're thinking about a Starbucks, Estee Lauder, a Nike, Caterpillar," Cramer said, adding it could possibly even extend to Tesla and Apple.

On the other hand, Cramer said he's "not worried" about American banks because their access to the Chinese market has largely been curtailed.

"The bottom line? I don't think the Evergrande fiasco will do serious damage to the U.S. economy, even as there are some groups that could get hit, but it does give investors a great excuse to do some selling," Cramer said. "Just sit this one out please, then you can buy stocks with zero China connection at better prices and not have to worry about a place you had never heard of until today called Evergrande."

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com