CNBC's Jim Cramer on Thursday laid out his favorite oil stocks, suggesting a more disciplined approach to capital spending has hit the industry and makes it possible for shares to keep rallying.

"Now that the oil industry has learned some discipline, I think prices could stay elevated for a long time, which means the rally in the oil stocks is probably — even though it's been amazing this year — far from over," the "Mad Money" host said.

Cramer turned against investing in oil stocks in early 2020, believing that it was becoming increasingly difficult to make money. However, Cramer said Thursday a "new dynamic" is hitting the energy sector, with companies being less willing to add drilling capacity as oil prices rise. That restraint helps keep oil prices at levels where the companies can make more money, he said.

"In that case ... you should be willing to own some of the newly disciplined oil producers," he said.

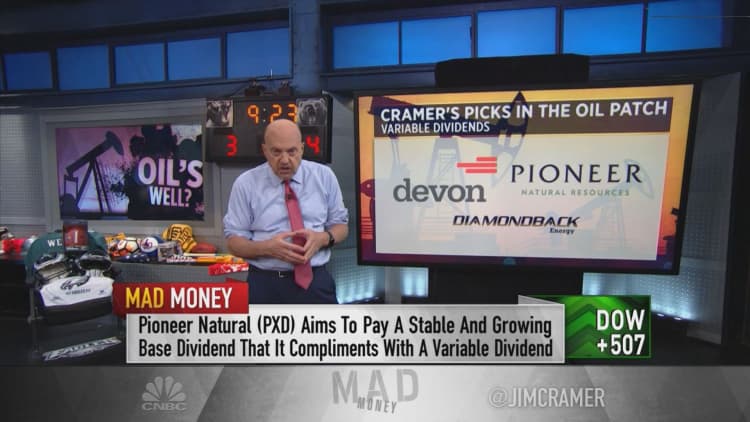

Here are his favorites:

Devon Energy

Cramer said he likes Devon Energy's variable dividend, which allows investors to receive a slice of the company's profits instead of just a set payment amount. "Rather than borrowing money to drill like crazy when business is booming, [CEO Rick Muncrief] wants to reward shareholders," Cramer said.

While the stock is up 107% so far this year, Cramer said he continues to "like it up here because, based on the way they calculate the variable dividend, it works out to be one of the best yields in the S&P 500."

Pioneer Natural Resources

Not long after Devon unveiled its variable dividend, Pioneer Natural Resources did the same, Cramer said. It wasn't supposed to start until next year, but in August the company moved the timetable up to begin making payouts almost immediately, he said.

"Based on what they paid last quarter, the stock's got a 5.2% yield, although it should be higher than that based on the company's cash-flow estimates for the next five years," Cramer said. "Plus, Pioneer's got some great assets in the Permian Basin that are worth a lot more as long as the industry remains disciplined about production."

Diamondback Energy

Previously "one of the most aggressive drillers out there," Cramer said Diamondback Energy is now placing a bigger emphasis on returning capital to shareholders. For now, it's doing so through a $2 billion buyback initiative due to where the stock is trading, Cramer said.

"Once it goes high enough, management says they'll roll out a variable dividend instead. Since then, this thing's been on fire, but I bet it's got more room to run," Cramer said.

Chevron

For investors who think the aforementioned exploration and production firms are "too risky," Cramer said Chevron is his favorite of the integrated oil companies.

"Not only are these guys disciplined about production, they've also gotten religion on climate change, spending $10 billion — up from $3 billion — to find ways to cut carbon emissions," Cramer said, noting he discussed the plan with CEO Mike Wirth on "Mad Money" last week.

"I think that's a better use of their money than renting more oil rigs. Plus, in the meantime, Chevron's paying you to wait with its bountiful and safe 5.4% yield," Cramer said.

Other names

Cramer said these "smaller, special situations" may be worth considering for certain investors:

- Denbury Resources: After declaring bankruptcy last year, Cramer said the company has "since emerged as a major player in carbon capture and storage — exactly the kind of thing Chevron's spending a fortune on."

- Tellurian: The company is focused on liquified natural gas, including developing the terminals necessary to ship the producer overseas where it's more expensive, Cramer said.

- ConocoPhillips: Cramer said ConocoPhillips is a well-run company that is likely to better manage the Texas oil assets it recently acquired from Royal Dutch Shell. "They just boosted the dividend. You almost get a 3% [yield]," he added.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com