CNBC's Jim Cramer said Tuesday one of his most-trusted technicians, Bob Lang, sees opportunities for investors to buy shares of high-growth companies at a discount.

"We got a huge meltdown in four of the most turbo-charged growth stocks today as higher interest rates spooked Wall Street away from this entire group," the "Mad Money" host said. "But the charts — as interpreted by Bob Lang — suggest that Affirm, Asana, Upstart and InMode are worth buying into weakness."

"I've seen Lang make these calls before after monster sell-offs, and he's been spot on. It would not surprise me if it didn't happen again," Cramer added.

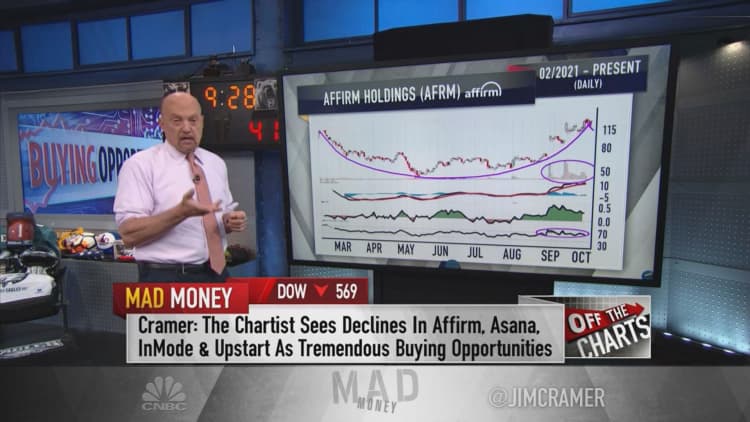

Affirm

Shares of Affirm — a large player in the burgeoning buy now, pay later space — fell 10.79% on Tuesday. Cramer said Lang believes "you need to treat any kind of pullback here as a chance to buy, not sell."

Multiple technical indicators support that view, in Lang's opinion, according to Cramer. The first is the Chaikin Money Flow, a measure of whether large money managers are buying or selling a security.

"Lately, the money flow's been very solid. Same goes for the Moving Average Convergence/Divergence line ... [which] is an important momentum indicator," Cramer said.

While Affirm was nearing overbought territory, Tuesday's decline makes that no longer the case, Cramer explained. "Lang says Affirm is his favorite of these growth plays and after the stock stabilizes, he thinks this is a just under $115 name that could run to $200 in the coming months."

Asana

Asana, which provides a cloud-based work management platform, entered Tuesday's session with its stock being considered overbought based on the Relative Strength Index, Cramer said. Then the stock dropped 10.3%.

Cramer said Lang likes that Asana shares were advancing on high volume. The Chaikin Money Flow and Moving Average Convergence/Divergence for the company are "both looking good, and Lang says there's robust option flow, too," Cramer added.

"He thinks the stock might be looking at a tight consolidation for the next few weeks, but as long as Asana doesn't go too much lower ... this could turn out to be an excellent buying opportunity," Cramer said.

Upstart Holdings

Lang believes the stock chart of online lending platform Upstart Holdings looks like "a Rembrandt," Cramer said, after shares ripped higher in August. "The stock's made a series of higher highs and higher lows, including in the last few weeks when the market was rolling over," Cramer said.

However, the technical analyst thinks Upstart was due for a pullback, in part because its reading on the Relative Strength Index flashed overbought.

"The problem is, the dips here have been very shallow — you rarely get a chance to buy it on weakness," Cramer said, noting Upstart's 5.6% decline Tuesday was much less than the other three highlighted stocks.

"In Lang's view, you're getting a great opportunity here. He'd be a buyer into this pullback, and he's buying more if it keeps getting hit because Upstart's a $313 stock that he sees going to $400," Cramer said.

InMode

Shares of medical technology company InMode tanked nearly 13% Tuesday, a move Cramer said he finds understandable because the stock had more than doubled since the spring.

"That's why Lang likes it so much. InMode's given you a terrific pattern of higher highs and higher lows," Cramer said. He added that the Moving Average Convergence/Divergence indicator "just made a bullish crossover ... where the black line goes above the red one, and it's a very reliable signal."

InMode shares dipped below their 20-day moving average as a result of the steep decline. However, Cramer said when that's happened previously the stock has been a "screaming buy."

Lang believes "this time will be no different, and when the stock resumes its run, he's looking at a $200 price target," Cramer said.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com