Rising inflation suddenly has Americans even more worried about their retirement.

Prices for goods and services have been moving higher over the last several months and, for the first time in a long stretch, it's top of mind for consumers.

"We have had such a benign environment from the standpoint of inflation, so I think we all got a bit complacent," said Christine Benz, head of personal finance at Morningstar. "Inflation had been so low for so long."

In fact, inflation is now retirees' top concern, a survey by Personal Capital and Kiplinger's Personal Finance found. Fully 77% cited declining purchasing power as a major worry, followed by health care (74%) and the financial strength of Social Security (71%).

Yet there are strategies to help protect your retirement portfolio against inflation, depending on how close you are to retirement.

In your younger years

You should have liquid savings, or cash, to cover about three months to six months of living expenses in the event of an emergency, as well as savings for any other planned expenditures, like the purchase of a home. That's it, according to certified financial planner James Burton, chief marketing officer at Personal Capital.

"It is tempting to keep a lot of money in cash because it feels secure, but the truth is it is not secure," he said. "It is likely to be eroded by inflation very significantly over time."

More from Invest in You:

The ultimate retirement planning guide for 2021

Want a happy retirement? Here's what experts say you need to do

If you don't want to fully retire, phased retirement may be the answer

For instance, consumer prices jumped more than 5% in July. Yet bank interest rates on savings accounts are well below 1%.

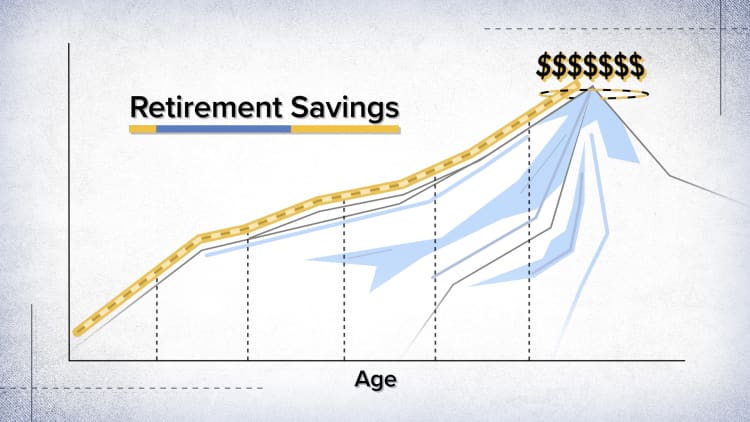

The bulk of your retirement portfolio should be in stocks when you are under age 50, said Benz at Morningstar. The S&P 500's average annual rate of return over the last 20 years is 9.55%, according to FactSet.

"That should help you defend against inflation and should help it continue to grow above inflation," she said.

Closer to retirement

In your 50s, start moving a little more of your portfolio into safer assets, like fixed income, to protect you against a stock market shock in the early years of retirement, Benz said.

Some of your fixed income can be in Treasury inflation-protected securities. Like traditional Treasury bonds, TIPS are issued and backed by the U.S. government. However, TIPS offer protection against inflation because the principal portion changes with inflation, as measured by the consumer price index.

While not essential, you can also consider assets that have historically been correlated with inflation, such as commodities, she said. "They have shown some ability to hedge against inflation."

You can also diversify your equities, adding areas such as natural resources and energy, as well as real estate, Benz suggested.

In your 60s, you have to start thinking seriously about what your income source will be in retirement. For many, Social Security is part of the equation, and it is an inflation-adjusted benefit. In 2022, the cost-of-living adjustment could be as much as 6%.

In retirement

Once you are no longer working, you will be pulling income from your retirement accounts. Benz suggests having about 20% of your bond portfolio in TIPS. You can also look into other categories such as commodities.

Historically, junk bonds provide higher yields to protect against inflation, although that is not the case at the moment, Benz said.

"Every rock has been turned over in search of yield," she said. "You are just arguably not getting paid to take on the credit risk."

Remember, while you need income, you are still saving for later years in retirement.

"Retirement isn't switching to an all-cash situation," said Burton at Personal Capital. "It is important to stay invested."

SIGN UP: Money 101 is an 8-week learning course to financial freedom, delivered weekly to your inbox.

CHECK OUT: This 33-year-old online baking instructor brought in nearly $335,000 in 2020: Here's how via Grow with Acorns+CNBC

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.