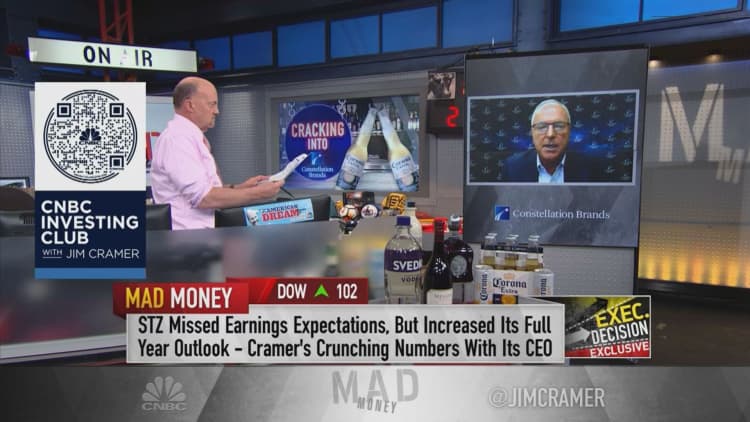

Constellation Brands CEO Bill Newlands told CNBC's Jim Cramer on Wednesday he still sees growth opportunities for hard seltzer, while acknowledging the once-sizzling category has cooled off in recent months and may stay that way.

In an interview on "Mad Money," Newlands said that relative deceleration in hard seltzer sales played a big part in the company missing per-share earnings estimates in its latest quarter, which it reported before Wednesday's opening bell.

While revenue exceeded projections, Constellation, the parent company of Corona and Modelo, said it earned an adjusted $2.38 per share in the quarter ending Aug. 31, compared with Wall Street's consensus estimate of $2.77. The company recorded a $66 million obsolescence charge related to excess hard seltzer inventory.

"Our entire miss was because of the obsolescence charge," Newlands said. "When you look at our top line, you've got brands like Modelo that were up 16%. That continues to increase household penetration and velocity. ... You see great takeout on some of our key wine brands. We remain extremely excited about the growth profile of all of our brands," he continued.

"We had a one-time charge that obviously hurt the bottom line, but we raised guidance because we have a lot of confidence in being able to absorb that charge and still beat the numbers at the end of the year."

Constellation Brands, which launched its Corona Hard Seltzer last year, is not the only alcoholic beverage company to face challenges in the category.

Boston Beer reported weaker-than-expected quarterly results in July as a result of sales of its Truly hard seltzer brand. In September, Boston Beer pulled its earnings guidance as the slowdown continued.

Hard seltzer exploded in popularity in 2019, with White Claw becoming one of the most well-known offerings. It prompted a flood of new entrants into the market from like likes of Constellation, Bud Light-parent Anheuser-Busch InBev and others, as companies tried to seize the opportunity at a time of declining beer consumption.

"Certainly, the seltzer category has had a bit of a lid put on it in the last, say, eight weeks or so, and everybody overestimated what the growth profile was going to look like for this year. But it's still a fairly minimal part of our business," Newlands told Cramer, explaining that Constellation sees its core beer business as its main driver of growth.

"We still think that seltzer is going to be an important part of the category going forward, but probably at a much lower growth profile," he said.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com