European Central Bank President Christine Lagarde on Thursday tried to play down the chances of a rate hike for 2022, hinting that market players might be getting ahead of themselves with their predictions.

The euro zone's central bank decided to keep interest rates and its monetary policy stance unchanged despite ongoing inflationary pressures.

Some market participants believe the ECB is underestimating current inflationary pressures and will therefore likely have to announce a rate hike before the start of 2023. Indeed, money markets have priced in the probability of a 20-basis point hike for December 2022.

But Lagarde remained resolute at her news conference Thursday.

"Our analysis certainly does not support that the conditions of our forward guidance are satisfied at the time of liftoff as expected by markets, nor anytime soon thereafter," she told CNBC's Annette Weisbach.

"We really looked and very deeply tested our analysis of the drivers of inflation, and we are confident that our anticipation and our analysis is actually correct."

She later added that it wasn't for her to say whether markets were wrong with their predictions.

Bond yields spike

Markets were fairly muted after the ECB's rate announcement, but southern European bond yields spiked following Lagarde's comments at the news conference, according to Reuters data.

Her remarks come after ECB Chief Economist Philip Lane recently stated his position on rate hikes, saying market predictions didn't reflect what the bank had guided for. The ECB has previously said it would only start to increase interest rates from their record lows when inflation remains at 2% for the medium term.

At the moment, the bank's forecasts do not show consumer prices at those levels for a sustained period.

The ECB foresees inflation at 2.2% in 2021, 1.7% in 2022 and 1.5% in 2023 — thus below its 2% target. The bank will be updating those forecasts in early December.

Soaring inflation

The central bank announced in September it would be buying fewer bonds off the back of surging consumer prices. Inflation in the euro zone hit 3.4% in September, representing a 13-year high.

At the time, Lagarde made it clear this was a recalibration, but not tapering. This is because the ECB is of the view that higher inflation is temporary and will fade throughout 2022.

"Rising energy prices, the recovery in demand and supply bottlenecks are currently pushing up inflation. While inflation will take longer to decline than previously expected, we expect these factors to ease in the course of next year. We continue to foresee inflation in the medium term remaining below our 2% targets," Lagarde said Thursday.

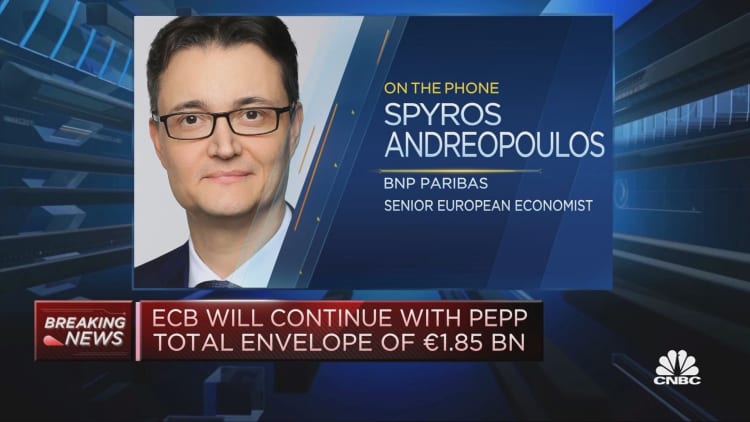

ECB watchers are expecting Lagarde to announce a formal tapering in December. The central bank's Covid-19 stimulus program — known as the Pandemic Emergency Purchase Program — is due to end in early March of next year. So, many analysts are expecting a readjustment in the bank's stimulus ahead of that.

Some have pointed out that the ECB will likely keep buying government bonds but through other less-flexible programs.

Correction: Some market participants believe the ECB is underestimating current inflationary pressures and will therefore likely have to announce a rate hike before the start of 2023. An earlier version misstated the time period.