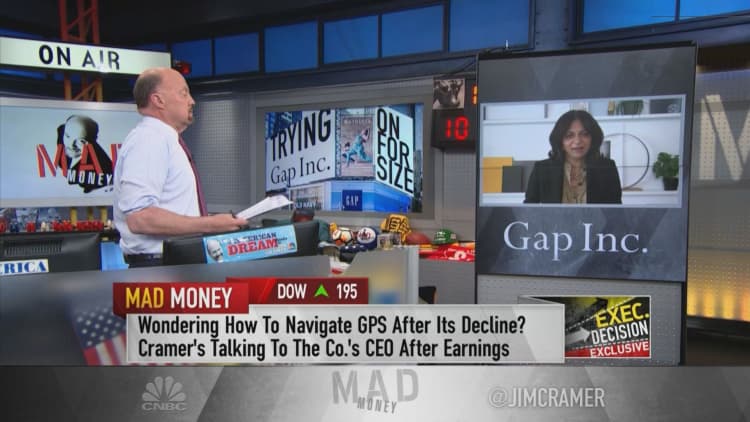

Gap CEO Sonia Syngal on Tuesday defended the apparel retailer's air freight investments, telling CNBC's Jim Cramer the near-term profitability impacts were worth taking ahead of the crucial holiday shopping season.

In a "Mad Money" interview after Gap's disappointing quarterly results, Syngal said the company decided to take those costly transportation steps to overcome what proved to be longer-than-expected Covid closures in Vietnamese factories.

"We believe the right thing to do is compete in the holiday season to have the right stock across all four of our brands, and that's what we're doing," Syngal said, referring to Old Navy, Gap, Banana Republic, and Athleta.

Gap is far from the only retailer dealing with inventory problems, as global supply chains remain unsettled by pandemic-related factors. Nevertheless, Syngal said supply-related constraints are weighing on Gap.

"About a half billion top line [revenue] affected by stock out, and about a half billion of transitory air costs that we're incurring" to ensure products arrived at their intended end markets, she said.

Gap shares plunged 16% in extended trading Tuesday as Wall Street reacted to the company's weak third-quarter results and forecast changes. Gap earned an adjusted 27 cents per share, compared with estimates of 50 cents, according to Refinitiv. Sales of $3.94 billion fell short of the expected $4.44 billion.

The company also lowered its full-year guidance for sales and earnings, both of which now check in below where analysts polled by Refinitiv had projected.

"I would much rather have a supply problem than a demand problem ... and that's what we're navigating," Syngal said. The CEO acknowledged she was "disappointed in this particular quarter," but stressed it was "all in focus and support of our customer and competing in holiday."

Sign up now for the CNBC Investing Club to follow Jim Cramer's every move in the market.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com