Columbia Sportswear's strong fourth-quarter profitability was helped by consumers starting their holiday shopping earlier than years past, CEO Tim Boyle told CNBC's Jim Cramer on Friday.

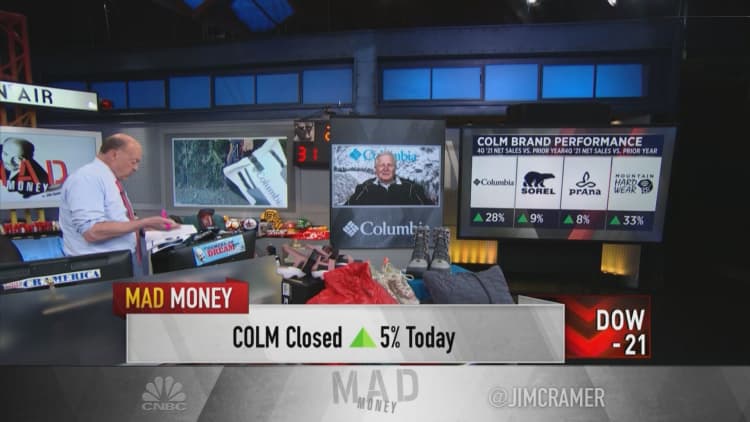

Shares of the outdoor-focused apparel maker jumped 5% Friday, after the company a day earlier reported a 64% year-over-year jump in net income in Q4 and issued robust full-year guidance.

"In today's environment where there was so much impact on supply chain, shortages really all over the world, I think we were helped a bit because consumers moved earlier to buy whatever they needed for their holiday and winter products," Boyle said.

"That made for lack of promotional activity in our stores and also through our retail partners. Their promotions were smaller, as well," Boyle continued.

Columbia's operating income of $211.6 million in the fourth quarter was a record for the Oregon-based company. It represented 18.7% of net sales, compared with 13.5% of net sales in the same quarter in 2020.

Columbia projects sales between $3.63 billion and $3.69 billion in 2022, a potential increase between 16% and 18% compared with 2021 figures. Cramer told Boyle he was impressed by the company's guidance, given the challenging business environment with inflationary pressures and a disheveled supply chains.

"Much of it is based on the fact that we have quite broad omnichannel business," responded Boyle, who has led Columbia since 1988. "We sell to a lot of retailers globally. We've got orders from those retailers, which are going to basically fill our order book this year, so it gives us a great amount of confidence in our future."

Columbia shares are down just under 3% year to date after Friday's advance. Over the past three months, the stock is down 9.7%, based on Friday's closing price of $94.59. The stock's all-time high of $114.98 came on April 29.

Sign up now for the CNBC Investing Club to follow Jim Cramer's every move in the market.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com