A full recap of the Fed's rate hike and big market rally

The Federal Reserve raised rates by 50 basis points, as was widely expected. But it was Chairman Jerome Powell's comments that sparked a sharp rally in stocks. Powell said that the Fed wasn't considering raising rates by 75 basis points. The major U.S. stock benchmarks surged to their highs of the day on those remarks.

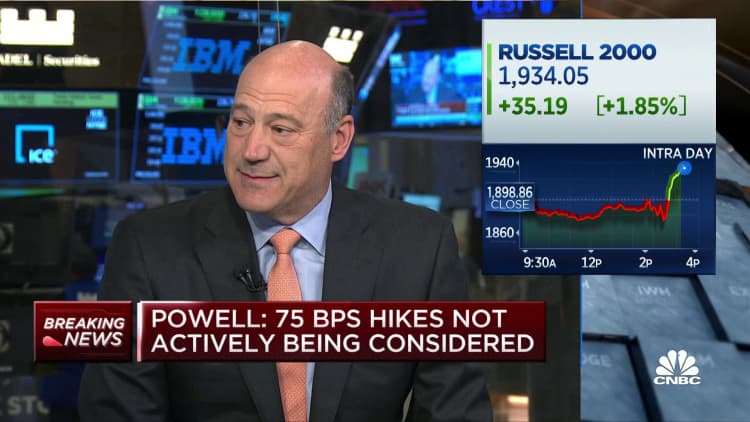

Gary Cohn says Powell gave the market the policy transparency it wanted

Former Goldman Sachs President Gary Cohn told CNBC he thinks Fed Chair Jerome Powell "drove it right down the middle of the road" during his news conference, perfectly meeting the market's expectations as evidenced by the relief rally in stocks.

In particular, Cohn said the market appreciated Powell's clear communication around the Fed's approach to quantitative tightening. "The market has been trained to have transparency, and we got transparency," said Cohn, who also led the National Economic Council under former President Donald Trump.

He added that he believes Powell laid the roadmap for two more 50 basis point interest rate hikes at upcoming meetings.

— Kevin Stankiewicz

watch now

Stocks rally broadly after Powell comments, financials and tech jump

U.S. stocks rallied across the board Wednesday after Fed Chair Powell in the press conference ruled out larger rate hikes and emphasized the possibility of a soft landing — tamping down inflation without inducing a recession.

All 11 S&P 500 sectors were positive on the day in the last hour of trading.

Stocks leveraged to an improving economy were among the biggest winners. Energy was the top-performing sector. Financial names were also a leading group, with names like Bank of America and Wells Fargo jumping roughly 4%.

Technology stocks, which have been under pressure, also climbed. Communication services and information tech were among the top S&P 500 sectors. The moves came as the benchmark 10-year Treasury yield dipped. Apple rose more than 3%, and Meta Platforms gained roughly 5%.

—Hannah Miao

Market is applauding Powell's comments, LPL's Krosby says

The major averages were up sharply heading into the close, with the Dow up 900 points.

"The market is applauding Chairman Powell's comments that the economy remains strong thanks to solid corporate balance sheets and still cash-rich consumers,: said Quincy Krosby, chief equity strategist at LPL Financial. "Moreover, he suggested that perhaps the worst of the sharp move in inflationary pressures may be poised to ease."

"Still, Powell underscored that while the FOMC remains data dependent for each meeting, the market can expect 50 basis point hikes at the next two meetings. He made it clear that corralling inflationary pressures is crucial," Krosby added.

—Fred Imbert

Powell news conference wraps up

Federal Reserve Chairman Jerome Powell has concluded an eventful news conference, which saw the major U.S. stock benchmarks rally on remarks that the Fed would not raise rates by 75 basis points.

—Fred Imbert

Federal Reserve will restore stable pricing as 'quickly and effectively' as it can, Powell says

Chairman Jerome Powell believes the Federal Reserve has a "good chance" of restoring stable prices without causing a strong increase in unemployment.

"We need to do everything we can to restore stable prices as quickly and effectively as we can," Powell said. "We think we have a good chance to do it without a significant increase in unemployment or a really sharp slowdown."

While the move may not be "pleasant" and requires higher rates in the short-term, everyone will benefit in the long run, Powell said. Those on fixed income or lower end of income distribution particularly benefit from stable prices, he added.

"We think about the medium and longer-term and everyone will be better off if we can get this job done," he said. "The sooner the better."

— Samantha Subin

Powell's comments on rates, economy soothed investors and triggered rally

State Street Global Advisors chief investment strategist Michael Arone said the Federal Reserve delivered on its guidance and eased investors' concerns about the path of its rate hiking.

He said Fed Chairman Jerome Powell soothed markets with his comments, including when he said a 75 basis point hike was not currently under consideration. The Fed raised interest rates by a half percent Wednesday afternoon, the biggest hike since the year 2000.

"I think there's three things" in Powell's comments, Arone said. "They're not actively considering 75 basis points. There's some evidence that inflation may have peaked. And thirdly, he acknowledged it won't be easy but he thinks a soft landing is still possible because households, businesses and the labor markets remain in good shape."

The chairman also said the Fed could consider 50 basis point hikes at the next couple of meetings, and Arone said it was a positive that Powell limited the half point hikes to two meetings.

The major averages were up sharply at around 3:15 p.m. ET, with the Dow up more than 700 points. The S&P 500 and Nasdaq are up more than 2% each.

—Patti Domm

We’re very long away from neutral now and we’ll get there expeditiously, Powell says

watch now

—Fred Imbert

Strategist breaks down why stocks are rallying

Adam Crisafulli, founder of Vital Knowledge, broke down why stocks rallied during Powell's press conference.

"Stocks were excited about Powell refuting talk of 75bp increases and his (very modest) optimism about recent PCE trends, but his rhetoric about combating price increases was even more forceful than before," Crisafulli said.

— Yun Li

Powell says Fed policies are 'famously blunt tools'

Fed Chair Jerome Powell said the central bank has a "good chance" to curb inflation without inducing a recession, but noted challenges in that endeavor.

"We don't have precision surgical tools. We have essentially interest rates, the balance sheet and forward guidance and they're ... famously blunt tools," Powell said at the press conference.

"No one thinks this will be easy. No one thinks it's straightforward. But there's certainly a plausible path to this," he added.

—Hannah Miao

Traders reduced bets for rate hikes this year

Traders are reducing thier expectations for Federal Reserve rate hikes this year.

Traders had been expecting a possible 75 basis point rate hike in June, but Fed Chairman Jerome Powell said that is not currently under consideration. The chairman also said the Fed could consider 50 basis point hikes at the next couple of meetings.

According to Wells Fargo's Michael Schumacher, fed funds futures were pricing in 52 basis points of hiking in June after Powell's comment, down from 61 basis points before the 2 p.m. ET Fed statement.

The futures market also shows traders reduced expectations for rate hikes this year. The futures market is now pricing in a fed funds rate of 2.80% at the end of the year, down from 2.96% before the Fed's statement.

The Fed announced it was raising the fed funds rate by a half percentage point and said it "remains highly attentive to inflation risks."

—Patti Domm

Powell emphasizes Fed policy works on demand, not supply

Fed Chair Jerome Powell reiterated the central bank's policy fights inflation through curbing demand, and cannot address supply side issues.

"Our tools don't really work on supply shocks, our tools work on demand," Powell said at the post-policy meeting press conference.

The Fed chair also highlighted the war in Ukraine and Covid case surges in China as two geopolitical issues that could further exacerbate global supply chain disruptions.

"For both the situation in Ukraine and the situation in China, they're likely to both add to headline inflation," Powell said. "They're both capable of preventing further progress in supply chains ... or even making supply chains temporarily worse."

—Hannah Miao

Powell says he's not 'actively considering' 75 basis point increase

Federal Reserve Chairman Jerome Powell said the central bank is not "actively considering" a 75 basis point increase.

"So a 75 basis point increase is not something that committee is actively considering," Powell said. "I think expectations are that we'll start to see inflation, you know, flattening out."

"It's a very difficult environment to try to give forward guidance 60, 90 days in advance, there's just so many things that can happen in the economy around the world. So, you know, we're leaving ourselves room to look at the data and make this decision as we get there."

— Sarah Min

watch now

Powell: The labor market is 'extremely tight'

"The labor market has continued to strengthen and is extremely tight," according to Federal Reserve Chairman Jerome Powell.

The chairman noted that labor supply remains subdued even as labor demand gains strength. Employment rose by 1.7 million jobs over the first three months of the year, and the unemployment rate has dropped to a near five-decade low of 3.6%, according to the Fed chair.

The result is employers are having difficulties filling job openings and wages are rising at the fastest pace in many years, Powell said.

— Sarah Min

Situation in Europe and China likely to add to headline inflation, Jerome Powell says

watch now

—Fred Imbert

Powell sees 'good chance' of a soft-landing for economy

Federal Reserve Chairman Jerome Powell said the central bank has a "good chance" of achieving a soft landing for the U.S. economy as it hikes rates to combat rising inflation.

"I would say I think we have a good chance to have a soft or softish landing, or outcome if you will," Powell said.

While maintaining a soft landing will be a challenge, Powell pointed to the resilient labor market, noting that households and businesses remain in "strong financial shape."

"It doesn't seem to be anywhere close to a downturn," Powell said. "Therefore, the economy is strong and is well-positioned to handle tighter monetary policy."

—Samantha Subin

Major averages rally after Powell rules out 75 basis point hike

The Dow, S&P 500 and Nasdaq jumped to their highs of the day after Fed Chairman Jerome Powell said the central bank wasn't considering a 75 basis point rate hike.

The Dow was up more than 400 points, or 1.5%. The S&P 500 traded 1.4% higher, and the Nasdaq advanced 1.2%.

—Fred Imbert

Powell says half point increases at next FOMC meetings are on the table

Fed Chairman Jerome Powell said Wednesday that, with the labor market being "extremely tight" and inflation "much too high," the Federal Open Market Committee could continue to raise the Fed Funds rate over the next few months.

"We are on a path to move our policy rate expeditiously to more normal levels," he said. "Assuming that economic and financial conditions evolve in line with expectations, there is a broad sense on the committee that additional 50 basis point increases should be on the table at the next couple of meetings."

He added that the committee also decided to begin the process of reducing its balance sheet, which will play an important role in forming the stance of monetary policy.

— Tanaya Macheel

Powell: Fed is 'moving expeditiously' to bring down inflation

The Fed is "moving expeditiously" to combat rising inflation which has hard-hit consumers, said Chairman Jerome Powell to start the central bank's post-announcement news conference.

"Inflation is much too high and we understand the hardship it is causing, and we are moving expeditiously to bring it back down," he said. "We have both the tools we need and the resolve it will take to restore price stability on behalf of American families and businesses."

Powell added that the economy and country have "proved resilient" as they fight the conditions over the past two years and said that bringing down inflation is crucial to creating a "sustained period" of strong labor market conditions.

—Samantha Subin

watch now

Oil's surge adds to inflationary pressures

Federal Reserve Chairman Jerome Powell pointed to the rapid rise in commodity prices, prompted by Russia's war, as adding to inflationary pressures across the economy.

"The surge in prices of crude oil and other commodities that resulted from Russia's invasion of Ukraine is creating additional upward pressure on inflation," he said Wednesday.

West Texas Intermediate crude futures, the U.S. oil benchmark, traded around $107.51 per barrel Wednesday. The contract is up more than 40% this year, which has sent gas prices at the pump to record highs.

— Pippa Stevens

Dow briefly erases gains as Powell kicks off news conference

The Dow Jones Industrial Average briefly turned negative on the day as Fed Chairman Jerome Powell started his news conference.

The 30-stock average was last up 64 points, or 0.2%. The S&P 500 hovered around the flatline, while the Nasdaq Composite was down 0.5% as of 2:36 p.m. ET.

—Fred Imbert

Market action shows Fed's rate hike well telegraphed, strategist says

The Fed just announced its biggest rate increase in two decades, and yet stocks are not selling off.

"It's certainly heady days when the market doesn't blink at the most aggressive rate hike in 22 years, but keep in mind this was extremely well-telegraphed and priced in," said Mike Loewengart, managing director of investment strategy at E-Trade. "So far though, we don't have much to go on in terms of the pace and magnitude of hikes to come."

—Yun Li

Market relieved Fed wasn't more hawkish, State Street's Arone says

State Street Global Advisors chief investment strategist Michael Arone said the market is breathing a sigh of relief after the Fed's latest announcement.

"I think right now there's relief it wasn't more hawkish," Arone said, noting the Fed is also pushing the idea that it will keep raising rates.

"I think one of the things that was most interesting was that the Fed decided to shift the description of transitory from inflation to the economy," he added. "They acknowledged the weakness in the economy, but their language suggested this was temporary and household spending and business spending remains strong. I thought that was an interesting way for them to support the need for more rate hikes."

—Patti Domm

Dow and S&P 500 rise to session highs after rate hike

The Dow and S&P 500 rose to their highs of the day shortly after the Fed announced its latest decision on monetary policy.

At one point, the Dow was up as much as 255.77 points, or 0.8%. The S&P 500 was briefly up 0.86%. Both benchmarks have since eased from those levels, but remain higher on the day.

—Fred Imbert

What changed in the Fed statement

Key changes to the statement include from the March 16 meeting include the central bank noting that "COVID-related lockdowns in China are likely to exacerbate supply chain disruptions. The Committee is highly attentive to inflation risks."

Click here to see what else has changed in the statement.

—Fred Imbert, Hannah Miao

Fed raises rates by 50 basis points, biggest hike in 2 decades

The Fed raised rates by 50 basis points, marking the central bank's biggest rate hike since 2000.

Wednesday's statement noted that economic activity "edged down in the first quarter" but noted that "household spending and business fixed investment remained strong." Inflation "remains elevated," the statement said.

The Fed also said it will begin reducing its massive $9 trillion balance sheet on June 1.

—Fred Imbert

Trading strategies for the post-Fed market

Strategists say odds are greater that the Federal Reserve will sound dovish in its post-meeting communications, so a way to play the market may be to seek out stocks that have been most hit by expectations of rising rates.

Tech and consumer discretionary stocks are key places to look for stocks that could bounce, says Sam Stovall, chief market strategist at CFRA. There are specific subsectors within these groups that have more potential to pop.

—Patti Domm

Citi says stocks have further to fall before the Fed rethinks rate hikes

Historically, the market could count on the Fed to step in with easy policy to help limit big losses in equities. But with inflation running at 40-year highs, Citi analysts say the central bank could wait longer to take its foot off the breaks.

Data suggest the Fed could wait for the S&P 500 to sink to the 3,800 level, or 9% below Tuesday's close.

"High inflation constrains the Fed, making easing monetary policy less likely if growth (or markets) fall," Citi analyst Alexander Saunders said Wednesday. "We have long argued that elevated inflation would put the Fed in a bind — when growth weakens they would not be willing to or able to ride to the rescue by loosening monetary policy."

— Tanaya Macheel

History shows these stocks beat the market as short-term rates climb

Short-term interest rates are on a tear this year, with the 2-year Treasury yield nearly quadrupling in 2022. With the Federal Reserve expected to hike the benchmark fed funds rate again in its May meeting, CNBC Pro screened for stocks that have outperformed during previous periods of rising short-term rates. Take a look at our list on CNBC Pro.

One name to emerge from our historical analysis is financial services firm Charles Schwab. The company benefits from rising rates in a number of ways. For example, the firm reinvests its customer balances at higher yields, while the rate it pays on those balances lags behind, widening the net interest margin. Sure enough, Schwab shares are up more than 5% this week ahead of the Fed meeting statement release and press conference.

—Hannah Miao

Stocks, bonds struggle since first hike

The first Fed hike in March didn't do much to calm markets.

Stocks initially rallied after the March Fed meeting, with the S&P 500 gaining more than 6% in the back half of the month. However, after a rough April, the broad market index has hit new lows for the year. The Nasdaq Composite has had an even rougher time and is down nearly 20% for the year.

Loading chart...

The sell-off in bonds has been even more dramatic. The 10-year Treasury yield was at 2.16% on March 15, the day before the first hike. That benchmark yield has traded above 3% several times this week.

— Jesse Pound

Take a look at where the markets stand ahead of the Fed's announcement

- S&P 500: up 0.25% at 4,185.25

- 10-year Treasury yield: up 3 basis points at 2.991%

- Dollar index: down 0.1% at 103.35

- Gold futures: down 0.1% at $1,868.20 per ounce

- U.S. crude futures: up 5.1% at $107.68 per ounce

- Bitcoin: up 3.5% at $39,965.66

—Fred Imbert

The case for a post-Fed relief rally

The market is so ready for the Federal Reserve's big rate hike later on Wednesday that it could see a relief rally once it has passed.

DataTrek's Nicholas Colas noted that the market's set-up heading into the Fed decision "is a near carbon copy" of the last two meetings. After those meetings, the S&P 500 rallied between 5.2% and 6.3% in the following one to two weeks, Colas said.

BlackRock's Rick Rieder has also noted that the Fed could spark a relief rally, adding that the recent market sell-off could be nearing its end.

Stocks are coming off a horrible April, with the S&P 500 falling more than 8% for its biggest monthly decline since March 2020.

—Fred Imbert

50 basis point rate hike expected

The consensus on Wall Street is for the Federal Reserve to raise rates by 50 basis points Wednesday. However, some investors still worry that Fed Chairman Jerome Powell could signal an even more aggressive monetary policy stance, as the central bank tries to stave off the strongest inflationary pressures seen in decades.

"I think they're going 50 [basis points], and it seems like they're dead set on hiking rates enough to kill inflation," Jim Caron, chief fixed income strategist on the global fixed income team at Morgan Stanley Investment Management, told CNBC earlier this week. "But that's the real debate. Are they trying to get to target inflation by 2024? If they are, the wage inflation is pretty high and that will require even more tightening than the Fed is projecting."

—Fred Imbert, Patti Domm