Investors looking to get into beaten-down cloud stocks at bargain basement prices may have missed their opportunity.

Scanning the cloud software market, which tanked to start the year, numerous stocks have jumped 50% from their lows. The WisdomTree Cloud Computing Fund, a sector-wide basket, has risen 26% in the past three months, while the S&P 500 is up less than 9% over that stretch. The cloud index is still badly underperforming the broader market for the year.

The macro data remains unfavorable for cloud companies, which ran up during the pandemic when interest rates were low and investors were paying big premiums for growth. Now, with the Fed in the midst of a hike cycle and inflation near a 40-year high, profits are at a premium as are dividends and products that consumers need in good times and bad.

However, even as cloud stocks were selling off at a dizzying pace in the first half of 2022, the companies behind those stock prices, for the most part, continued to chug along, proving that demand was still robust for their products and services.

Perhaps the market overcorrected, the companies are in fine shape and these stocks will again outperform when confidence returns to the market. That's the bet some investors have been making over the past few months, as they try to capture what they see as the easy money.

"Some of this stuff is coming back a little bit," said Elliott Robinson, a partner at Bessemer Venture Partners and co-founder of the firm's growth-investment practice. "We haven't seen the fundamentals of that basket of businesses really fall off a cliff."

For instance, consider GitLab, whose tools help software developers manage source code. The company's stock price plunged 75% between November and April. In June, the story changed.

Despite missing analysts' projections, GitLab posted 75% revenue growth from the prior year. Goldman Sachs upgraded the stock to buy from the equivalent of hold.

"In the near-term, GTLB is likely to see a more steady demand backdrop (relative to discretionary and complex IT solutions) as it provides key cost savings and operational efficiencies," Goldman Sachs analysts wrote in a report at the time.

GitLab's shares have doubled in the past three months, the sharpest gain among stocks in the WisdomTree fund. Data-processing software developer Confluent has seen the second biggest gain, up 81% since mid-May. On Aug. 3, Confluent reported a 58% increase in revenue for the second quarter and forecast growth of at least 46% for the year.

Confluent's technology "sits in the operational stack powering applications that directly serve critical business operations and real-time customer experiences," CEO Jay Kreps told analysts on the company's earnings call. "Given this criticality, it can't be switched off without a complete disruption to the operations of the business."

Following Confluent's report, Atlassian recorded 36% growth, topping estimates and boosting the collaboration software company's stock, which is now up 67% in three months.

The good news continued this week. On Thursday, restaurant-software maker Toast exceeded estimates for the quarter, with revenue climbing 58%, and the company lifted its guidance for 2022. That pushed the stock up more than 8% on Friday and 55% since May 12.

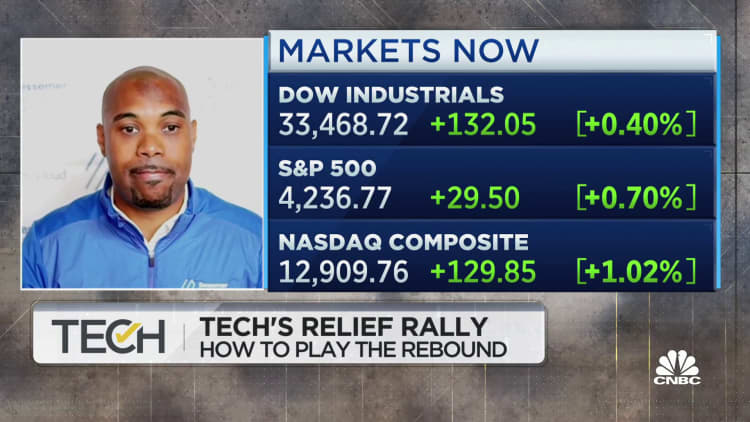

The cloud sector is getting an added boost from economic data that appears less threatening than it did a month ago. On Wednesday, the U.S. Bureau of Labor Statistics said the prices that consumers pay for goods and services rose more slowly in July than they did in June. Stocks rallied on optimism that the Fed may slow its rate increases.

But the cloud ascent hasn't been universal. In particular, companies with deep exposure to the consumer haven't fared as well.

Shopify has gained less than 30% in the past three months and remains about 77% off its high. The company's software is used by online retailers to help manage payments, inventory and logistics. In late July, Shopify missed estimates and warned that inflation and interest rates would weigh on the business in the second half of the year.

"We now expect 2022 will end up being different, more of a transition year, in which ecommerce has largely reset to the pre-Covid trend line and is now pressured by persistent high inflation," the company said in a statement on its financial performance.

Jamin Ball, an investor at Altimeter Capital, wrote in his weekly cloud newsletter on Friday that aggressive buyers in software stocks may be getting ahead of reality. He expects the U.S. to enter a recession and sees rate cuts possibly coming next year, with inflation easing.

"Based on the data we have today, I think the market is being too optimistic," Ball wrote. "I don't think we're in a recession yet, but I do think one is coming, probably in 2023."

Correction: A prior version of this story mischaracterized Ball's view on inflation and interest rates.

WATCH: Trading the cloud space