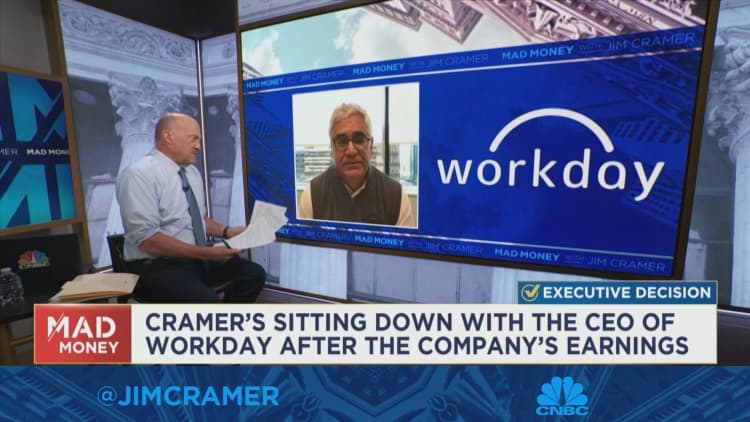

Shares of Workday surged more than 11% in extended trading Thursday after strong quarterly results, and the cloud software firm's co-CEO, Aneel Bhusri, offered upbeat commentary in an interview with CNBC.

"This focus on digital transformation; it just remains unabated. Companies are moving more and more things to the cloud. The pace is not slowing down," Bhusri told Jim Cramer on "Mad Money."

Workday, which makes software that companies use for financial management and human resources, reported adjusted earnings of 83 cents per share on revenues of $1.54 billion. Analysts had expected adjusted EPS of 80 cents on sales of $1.52 billion, according to Refinitiv.

Workday also reaffirmed its full-year guidance, a notable development in the face of concerns that a slowing and uncertain global economy will cause enterprises to rein in their spending.

"There's no question the macro environment is challenging for the second half of the year. I think it is for everybody," said Bhusri, who also co-founded Workday. "We had a couple deals slip from Q1 into Q2. Companies will talk about how they're slipping. We were able to close all those deals that slipped."

"We pretty much just ran the tables — it was across all products and all geographies," the executive added, while noting that Workday's financial applications, which can be used for functions like invoicing and revenue management, were particularly strong. "Maybe there was some pent-up demand there," he said.

Sign up now for the CNBC Investing Club to follow Jim Cramer's every move in the market.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com