Retirement accounts are a tax-advantaged way to build your nest egg — but tapping them too soon typically comes with a penalty.

However, the tax code waives that penalty in some circumstances. And federal lawmakers are about to add a few more waivers — for example, when people need money in the event of terminal illness, domestic abuse, natural disaster or another financial emergency.

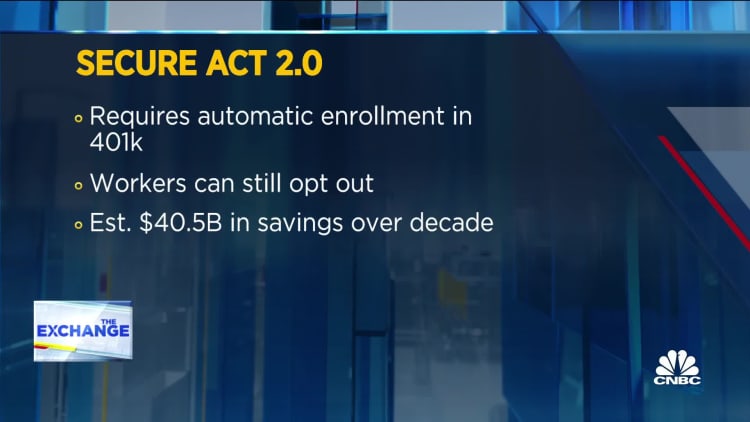

The changes are among a slew of retirement reforms — collectively known as "Secure 2.0" — that President Joe Biden is set to sign into law as part of a $1.7 trillion federal spending package. Congress passed the legislation last week.

Americans should try to avoid pulling money from retirement accounts early despite looser rules, financial experts said.

More from Personal Finance:

Tax-free rollovers from 529 plans to Roth IRAs starting in 2024

International travel poised 'for a big comeback' in 2023

Use this calculation to find the best used car for your money

"The worst thing you can do is take from your retirement account before its intended purpose, because then what will be there for your retirement?" Ed Slott, a certified public accountant and IRA expert based in Rockville Centre, New York, previously told CNBC. "I would only do this if it was the last resort and this was the only money you had."

New exceptions to the 10% tax penalty

Savers generally incur a 10% tax penalty if they withdraw money from a retirement account before age 59½. This is on top of any income taxes resulting from the withdrawal.

The following list outlines rules in the new legislative package that waive the 10% early withdrawal penalty for IRA owners. These measures also apply to savers with a workplace retirement plans like a 401(k).

1. Terminal illness

A terminally ill person wouldn't be penalized for withdrawing retirement funds before age 59½.

The law defines "terminally ill" as an illness or physical condition that can reasonably be expected to result in death within 84 months of a physician's assessment.

The rule takes effect upon enactment of the new law.

2. Domestic abuse

Victims of domestic abuse from a spouse or domestic partner may withdraw up to $10,000 in retirement funds within a year of the incident. The rule takes effect in 2024.

Individuals may need to access that money to help escape an unsafe situation, for example, the Senate Finance Committee said in a summary document.

The law defines domestic abuse as "physical, psychological, sexual, emotional, or economic abuse, including efforts to control, isolate, humiliate, or intimidate the victim, or to undermine the victim's ability to reason independently, including by means of abuse of the victim's child or another family member living in the household."

The victim can withdraw the lesser of $10,000 — an amount that will get adjusted upward according to inflation — or 50% of their account balance.

3. Financial emergency

Starting in 2024, taxpayers won't get penalized for withdrawing retirement funds for certain emergency expenses. These are "unforeseeable or immediate" costs related to personal or family emergencies.

Savers can make one financial emergency withdrawal of up to $1,000 a year. However, they can't take an additional withdrawal within three years unless they repay the initial distribution or make regular deposits that at least match the withdrawn amount.

4. Natural disasters

Savers can withdraw up to $22,000 without penalty in the case of a federally declared disaster.

The federal government sometimes issues one-off waivers associated with certain disasters, but the new law entrenches a permanent rule.

In addition, the funds can count as gross income over three years instead of one. Distributions can also be repaid to the retirement account.

Existing exceptions to the 10% tax penalty

In addition to the new rules, the tax code has several existing exceptions for those under 59½.

(Note: The first three apply only to IRAs. The others may apply to both IRAs and workplace retirement plans.)

1. Higher education expenses

You may be exempt from the penalty if IRA funds are used to pay qualifying higher-education costs for you, your spouse, or children or grandchildren of you or your spouse.

Eligible costs include tuition, fees, books, supplies, equipment required for a student's enrollment or attendance and expenses for certain special-needs services. Room and board also qualify for students who attend school at least half-time.

Students must attend a college, university, vocational school or other institution that can participate in U.S. Department of Education student aid programs. (These include "virtually all" accredited, public, nonprofit, and privately owned for-profit institutions, according to the IRS.)

2. 'First-time' homebuyer

Contrary to what the IRS title might suggest, IRA owners don't necessarily have to be first-time homebuyers to avail themselves of this exception. The IRS generally defines a first-time buyer as someone who hasn't owned a home in the last two years.

Such IRA owners can withdraw up to $10,000 without penalty. This dollar threshold is a lifetime maximum.

The funds must be used for "qualified acquisition costs." These are: the costs of buying, building or rebuilding a home, and "any usual or reasonable settlement, financing, or other closing costs," according to the IRS. The money must be used within 120 days of receipt.

The IRA withdrawal can be used for you, a spouse or your child, among other qualifying family members. If both you and your spouse are first-time homebuyers, each can take distributions up to $10,000 without penalty.

The two-year limitation period starts on the "date of acquisition": the day on which you enter into a binding contract to buy, or on which the building or rebuilding begins.

3. Health insurance if unemployed

Distributions to cover health insurance premiums for you, a spouse and dependents may not be subject to a penalty if you lost your job.

To qualify, you must have received unemployment compensation (via a federal or state program) for 12 consecutive weeks. The IRA withdrawal must also occur the year you received unemployment, or in the following year. Further, you must take the withdrawal within 60 days of being reemployed.

4. Death

Beneficiaries who inherit an IRA upon the owner's death generally aren't subject to a penalty if they pull money from the inherited account before age 59½.

5. Unreimbursed medical expenses

A distribution to cover medical costs may not be subject to penalty.

The exception applies to unreimbursed medical expenses that exceed 7.5% of your annual adjusted gross income. The applicable income is that during the year of withdrawal.

For example, if your AGI is $100,000 in 2022, you can use a withdrawal this year to cover unreimbursed medical expenses over $7,500.

You don't need to itemize tax deductions to get this benefit. (In other words, you can still get it if you take the standard deduction.)

Slott cautioned against one year-end snag. If you put a medical bill on your credit card this week or next, that medical expense would count for the 2022 tax year — even if the credit-card bill itself isn't paid until 2023.

That means an IRA withdrawal linked to that medical expense would have to occur in 2022, not 2023, to get the tax benefit.

6. Birth or adoption

Each parent can use up to $5,000 per birth or adoption from their respective retirement accounts. The funds would cover associated expenses.

The account withdrawal must be made within the year after your child was born or the date on which the legal adoption of your child was finalized.

7. Disability

Certain disabled retirement savers under age 59½ aren't beholden to the tax penalty.

To qualify, they must be "totally and permanently disabled." The IRS defines this as being unable to do "any substantial gainful activity" because of physical or mental condition. A physician must certify the condition "can be expected to result in death or to be of long, continued, and indefinite duration."

In all, it's a rigid definition that's hard to meet, Slott said. In practice, someone must generally be near death or bedridden and unable to work, he said.

8. IRS levy

You won't incur a penalty if the distribution results from an IRS tax levy (i.e., if the IRS takes your retirement funds to satisfy a tax debt).

9. Active reservists

Reservists in the Army, Navy, Marine Corps, Air Force, Coast Guard or Public Health Service may be exempt from penalty.

They must have been ordered or called to active duty after Sept. 11, 2001, and in duty for 180 or more days or for an indefinite period.

Their account distribution can't be made earlier than the date of the call to active duty and no later than the close of the active-duty period.

10. Substantially equal periodic payments

This exemption for IRA owners is "very complicated" and likely requires the help of an accountant or advisor, Slott said.

In basic terms, a taxpayer can avoid a penalty by sticking to a formula that outlines an amount of periodic account distributions (at least one per year). These "substantially equal periodic payments" are like an annuity, and are also known as 72(t) payments.

Not only must the saver determine the right amount to withdraw, but they must also stick to the schedule until age 59½ — leaving ample room for error, depending on the time scale, Slott said.

Getting it wrong can be costly. Taking the wrong amount one year, for example, would void the exception, and the taxpayer would owe the 10% penalty for each year of withdrawals that already occurred.

"It's a very harsh penalty," Slott said.