LONDON — European markets closed higher Tuesday as investors assessed China's reopening and digested inflation data.

European markets

The pan-European Stoxx 600 closed up 1.2%, with almost all sectors in positive territory. Europe's banking index rose 2.4% to lead gains, while oil and gas stocks bucked the trend to end the session down 0.7%.

Of the major bourses, the U.K.'s FTSE 100 closed up 1.4%, while Germany's DAX index added 0.8% and France's CAC 40 was up 0.4%.

Germany published lower-than-expected inflation figures for December, down to 9.6% year on year. They will be followed by inflation figures from France on Wednesday, Italy on Thursday, and a flash estimate for the whole euro area on Friday.

U.K. markets were closed Monday. Shares across the rest of the continent rose, as euro zone manufacturing data indicated that the worst may have passed for the 20-member currency bloc.

The figures offered hope of a light at the end of the tunnel, after a year beset by recession fears as central banks around the world hiked interest rates aggressively to rein in soaring inflation.

Meanwhile, markets in Asia-Pacific were mixed as investors weighed the short-term implications of the rise in coronavirus infections in China against the potential longer-term boost from the full reopening of the world's second-largest economy.

The Caixin purchasing managers' index showed further declines in factory activity on surging Covid-19 infections. But the survey also put business confidence around the 12-month outlook for output at its highest level since February 2022.

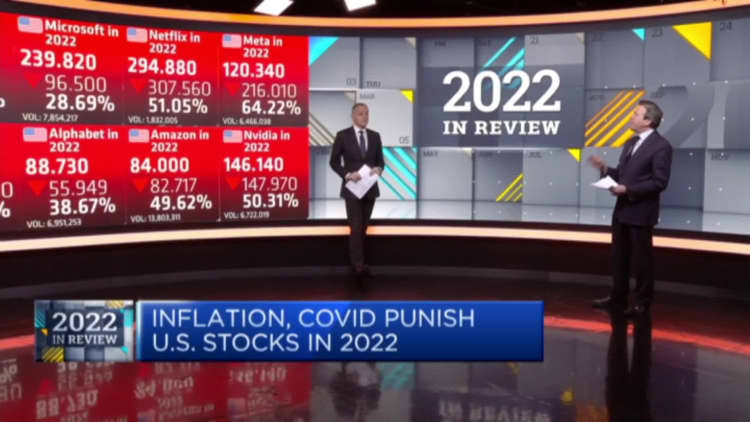

U.S. stocks wavered Tuesday, giving up earlier gains, as concerns such as rising rates and high inflation that knocked the market down last year continued to trouble investors in the new year.

The central bank hiked rates by 50 basis points in December following four consecutive 75 basis point increases. Markets will be keen to gauge the likely trajectory of monetary policy in 2023.