When certified financial planner Ted Jenkin sold his financial advisory practice in 2019, he signed a nonsolicit and noncompete agreement that prohibited him from taking clients from the firm for five years — or from taking any other job in the industry, anywhere in the country.

"When you sell a business, largely you are selling clients or ideas, but for you not to be able to do the work in this business makes no pragmatic sense whatsoever," he said. "It's insane."

Bound by this clause, Jenkin, who is a member of CNBC's Financial Advisor Council, stayed on as an employee until the end of last year.

"Now I can abide by the contract or do something in the industry and we'll have a legal battle," he said.

More from Personal Finance:

What the proposed ban on noncompete clauses means for you

3 money moves you should make this year, experts say

If you want higher pay, your chances may be better now

That is, unless a federal regulatory agency has its way.

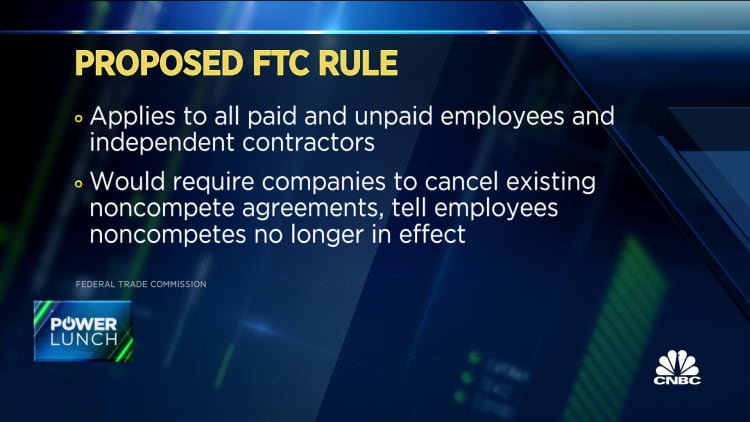

Recently, the U.S. Federal Trade Commission proposed a new rule banning the use of noncompete clauses in employee contracts nearly across the board because, the agency said, they suppress wages, hamper innovation and prevent entrepreneurs from starting new businesses.

The proposed rule would require companies with existing noncompete agreements to rescind them and inform current and past employees that they have been canceled, in which case Jenkin would be free to pursue other employment.

"I'd be the first person to start working again," Jenkin said. "I wouldn't have the fear of getting into a legal battle just because I'm working in my profession."

Nearly a fifth of U.S. workers sign 'noncompetes'

Noncompetes are widely used in industries such as finance but also, increasingly, in many other occupations as well, according to the FTC, "from hairstylists and warehouse workers to doctors and business executives."

Most often there is little wiggle room: Less than 10% of workers have any ability to negotiate these clauses, and 93% of them read and sign them anyway, according to the National Employment Law Project.

It's estimated that more than 30 million workers — or roughly 18% of the U.S. workforce — are bound by such agreements.

"Noncompetes block workers from freely switching jobs, depriving them of higher wages and better working conditions, and depriving businesses of a talent pool that they need to build and expand," FTC Chair Lina Khan said in a statement.

If this practice is stopped, wages could increase by nearly $300 billion a year, according to the FTC.

'Noncompete agreements are an important tool'

Still, there are several steps before the proposed regulation will go into effect, including the "inevitable litigation" challenging the FTC's authority, said Michael Schmidt, a labor and employment attorney at Cozen O'Connor in New York.

"Attempting to ban noncompete clauses in all employment circumstances overturns well-established state laws which have long governed their use and ignores the fact that, when appropriately used, noncompete agreements are an important tool in fostering innovation and preserving competition," said Sean Heather, the U.S. Chamber of Commerce's senior vice president for international regulatory affairs and antitrust.

An outright ban is "blatantly unlawful," Heather said. "Congress has never delegated the FTC anything close to the authority it would need to promulgate such a competition rule."

If it gets tied up in the court system, the rulemaking process could take up to a year or even longer, according to Schmidt.