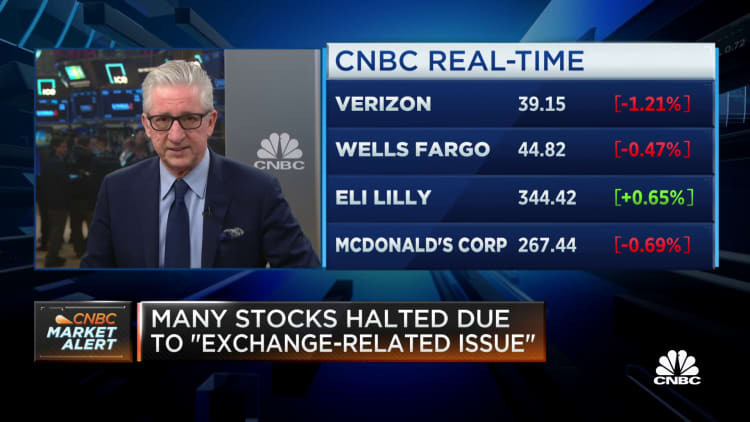

Trading in more than 200 stocks on the New York Stock Exchange was briefly halted shortly after the market opened Tuesday due to an apparent technical issue, and many abnormal early trades will be canceled.

The major names impacted included Morgan Stanley, Verizon, AT&T, Nike and McDonald's, according to the NYSE's website. Many stocks were shown to have abnormally large moves when the market opened, which may have triggered volatility halts.

Many of the companies impacted resumed trading before 9:45 a.m. ET. The NYSE said at roughly 9:50 a.m. that all of its systems were operational.

On Tuesday afternoon, the NYSE said in a statement that a system issue led to the exchange not conducting opening auctions for some of its listed securities.

The exchange said that some of the early trades in the impacted stocks will be declared null and void due to the error. The full list of the stocks that could see trades canceled is available on the exchange's website.

The NYSE is owned by Intercontinental Exchange, whose shares were down 2.2% on Tuesday.

The NYSE, like some other exchanges, has automatic halts in place for stocks that move dramatically in one direction or another. On a normal trading day, few if any stocks are halted for volatility on the NYSE.

The other major U.S. stock exchange, the Nasdaq, did not appear to be impacted by the technical issue.

Correction: The NYSE technical issue took place Tuesday. A previous version misstated the day of the week.