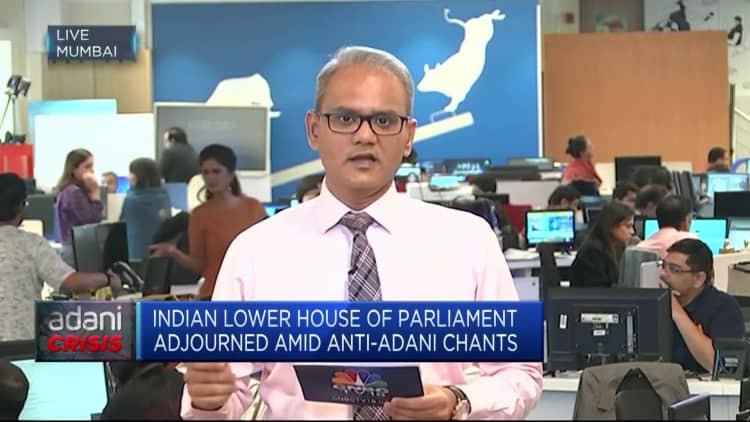

Stocks in the Asia-Pacific traded mixed on Friday as shares of Adani Enterprises briefly plunged, following a sell-off triggered by allegations raised by short seller firm Hindenburg.

The Nifty 50 in Mumbai closed up 1.3% as shares of some Adani companies rallied after a brief plunge earlier in the session.

Shares for Adani Enterprises closed up 1.38% after being down 35% at one point during Friday's session. Adani Ports closed up 7.8%.

Hong Kong's Hang Seng index fell 1.2% in its final hour of trade. In mainland China, the Shanghai Composite fell 0.66% and the Shenzhen Component lost 0.63% as the Caixin purchasing managers' index showed services activity in China picked up in January.

The Nikkei 225 in Japan rose 0.39% and the Topix traded 0.26% higher as the au Jibun Bank Japan Services Purchasing Managers' Index for January marked further growth for the month.

In South Korea, the Kospi also rose 0.47% to 2,480.4 and the Kosdaq gained 0.28% 766.79.

In Australia, the S&P/ASX 200 rose 0.62% to 7,558.1 as investors digest new housing loan commitments for December that fell 4.3%.

Overnight in the U.S., major indexes on Wall Street saw a rally driven by technology stocks. Meta surged 23%, marking its best day since 2013 after seeing a better-than-expected earnings report.