A top White House economist defended tax proposals aimed at the wealthiest Americans outlined by President Joe Biden during his second State of the Union address.

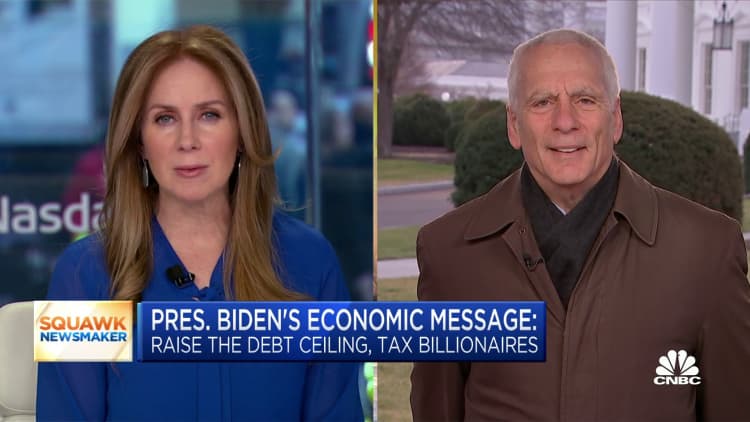

Jared Bernstein, a member of the White House Council of Economic Advisers, said Biden's tax proposal will target big corporations and the wealthiest Americans while protecting taxpayers who earn $400,000 a year or less from tax hikes.

"The days of the top 1% paying less than teachers and nurses ... those have got to be behind us as we inject fairness into the tax code to achieve fiscal rectitude," Bernstein said in an interview Wednesday on CNBC's "Squawk Box."

Biden signed into law a 15% minimum tax on corporations earning more than $1 billion in profits under the Inflation Reduction Act. A 1% excise tax on the value of stock buybacks, which can enable large corporations to avoid paying taxable dividends, was also passed under the act.

During his State of the Union address Tuesday night, Biden urged Congress to pass his so-called billionaire's tax, which proposes to impose a minimum 20% tax on households with a net worth of more than $100 million — a 12 percentage point increase from an average of 8% they currently pay.

Bernstein also defended the president's tax rate on capital gains, which he initially proposed in 2021. If enacted, the 48.6% rate with a 3.8% net investment income on long-term capital gains and qualified dividends would rate among the highest in the developed world.

The tax rate would apply to those earning over $1 million. The top 1% of earners paid 42.3% of all federal taxes in 2020, according to the Tax Foundation, which puts to question whether the wealthiest Americans pay lower taxes than teachers and firefighters.

"You called it a wealth tax on unrealized gains," Bernstein said of the capital gains tax proposal. "In fact, what it really is, or at least the way we see, it is a prepayment or withholding tax on future capital gains."

"If you're a wealthy individual or a corporation and you're paying a tax rate less than 15% on your corporate income, or less than 20% on your income, including ... capital gains, well, then we're going to change that and that's injecting fairness into this act," he said. "It's disallowing wealthy tax cheats to evade the code, and it helps to achieve the kind of fiscal responsibility that this president wants to build on in the rest of his first term."

Bernstein also addressed the ongoing debt ceiling debate and said that while Biden is willing to negotiate on fiscal matters, he won't negotiate when it comes to raising the federal debt limit, especially if cuts to Medicare and Social Security are on the table.

"We want to see what the Republican plan is," he said. "And I think if Republicans are true to their word and taking Social Security and Medicare off the table ... and military spending off the table, that means they would have to cut 85% of what's left. That's not realistic."