CNBC's Jim Cramer on Tuesday said that in order to steer through today's economic volatility, investors need to pay attention to three central things that are artificially driving the market crazy.

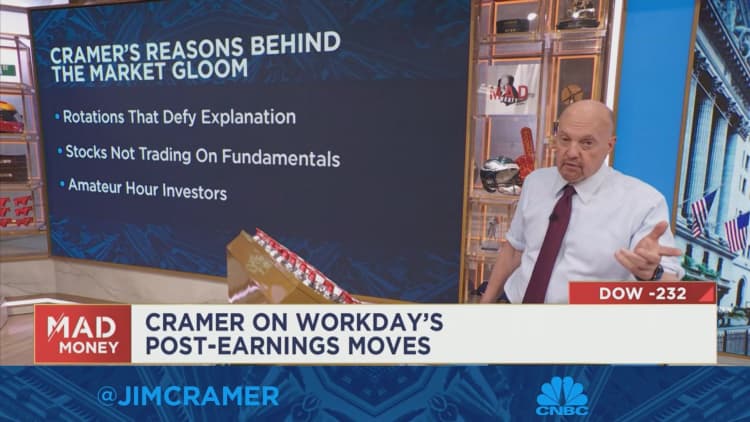

Cramer said that the market's instability is a product of circular investment reasoning, trades based disproportionately on the macro environment, and misunderstood earnings reports.

He pointed to health stocks that went up earlier Tuesday and then suddenly, for no visible reason, shot down. Companies like Merck, Johnson & Johnson, United Health, and others saw broad selloffs despite initial upswings. Instead of judging these companies based on their current health, Cramer said their stocks plunged "purely because they've been down. Well, there you go, that's total circular reasoning."

Cramer also noted that the market is out of whack because stocks are being used as "macroeconomic pawns" rather than getting judged on their individual merit. For example, tech stocks have been sensitive to the volatile bond market. As rates go up, investors assume that growth stocks like tech have less earning potential so tech goes down.

"I find this kind of action repugnant because it has nothing to do with what's really happening at individual companies," said Cramer.

Finally, Cramer blames the market chaos on misinterpretations of company earnings. Target, for instance, reported a strong quarter on Tuesday, but saw a baseless dip in shares because investors were not trading based on the correct metrics, Cramer explained.

To make the market make sense, Cramer said we need the following:

- Fund managers who "know what they are doing."

- Investors who trade on the company's actual performance, not just macroeconomic dynamics.

- Investments made on accurate analysis of earnings reports, not just the initial reaction.

In the meantime Cramer's advice to investors: "Put your emotions to the side and try to make reasonable decisions about individual stocks without letting the irrational action infuriate you."

Sign up now for the CNBC Investing Club to follow Jim Cramer's every move in the market.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com