Private equity firms Apollo Global Management and KKR are among the parties reviewing a book of loans held by Silicon Valley Bank, people familiar with the discussions told CNBC.

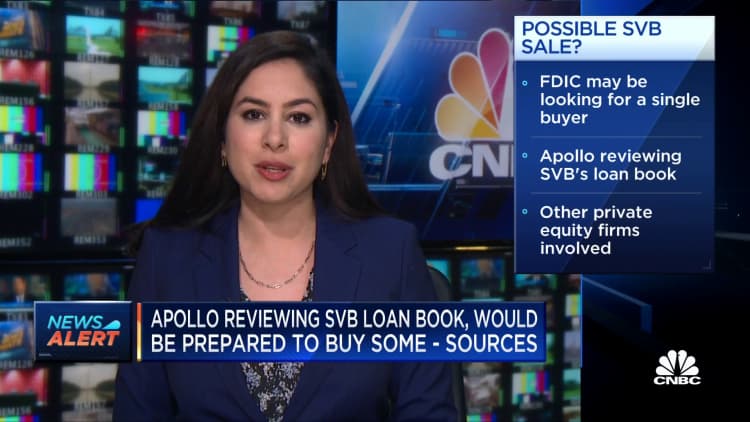

Two of those people said Apollo may be interested in acquiring a piece of the business at par. However, one of the people said it is unclear how the Federal Deposit Insurance Corporation plans to proceed since the regulator may prefer a single buyer for the assets.

The people CNBC spoke with requested anonymity since they weren't authorized to share confidential details about the discussions. The people also confirmed Blackstone and Carlyle Group are among those participating in the process, which is still at an early stage.

Previously, Bloomberg reported that several private equity firms have been conducting due diligence on the loan assets. That report, which cited several people with knowledge of the talks, said Apollo, Ares Management, Blackstone, Carlyle Group and KKR were among those reviewing a potential deal.

The companies declined to comment on the report.

The FDIC seized control of tech-focused SVB on Friday. Over the weekend, the agency held an auction, which failed to find a buyer. That prompted the regulator to create a bridge bank, which now houses the California-based bank's deposits. A plan was then devised Sunday to backstop SVB's depositors in order to prevent further panic in the financial system.

— CNBC's Christina Cheddar-Berk contributed to this report.