Stocks that rallied Tuesday in response to "less than stellar" quarterly reports could bode well for earnings season, CNBC's Jim Cramer said.

Cramer pointed to three companies that reported within the last 24 hours as examples: Spice company McCormick, Calvin Klein and Tommy Hilfiger parent company PVH and Walgreens. All three stocks "roared" Tuesday, but the reports were "disappointing," Cramer said.

PVH guided for 3%-4% revenue growth, which was above the 2.9% expected by Wall Street. The company reported earnings growth of 10%, above the 8.9% consensus number. Cramer said it was a good quarter that was "comfortably" better than expected, but these figures sent PVH's stock up almost 20% Tuesday.

"That is a truly staggering gain, as if it's got a takeover bid for heaven's sake," Cramer said.

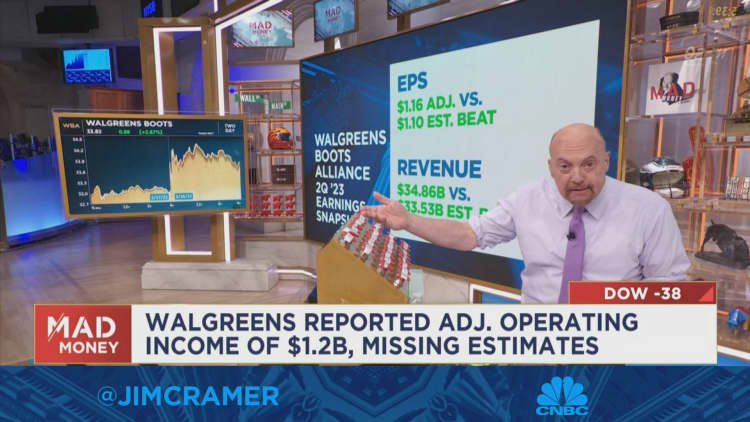

Walgreens' rally was also "totally baffling," Cramer said, because it reported an adjusted operating income of $1.2 billion that missed consensus estimates. Even so, shares of Walgreens jumped 2.7% Tuesday.

Similarly, shares of McCormick popped almost 10% after the company posted 5% net sales growth. Cramer said the figure was "not bad," but that the company achieved it with 11% growth from pricing actions and a 3% decline in volume and mix.

Despite what might appear to be lackluster numbers, Cramer said he thinks these companies' shares likely rose because investors were "thrilled just to see they finally aren't getting their butts kicked."

Cramer said he thinks these companies are representative of the broader market. He said companies have been struggling in recent years because of inflation across the supply chain, and now that expectations have been tamped down, the market can rally in response to less impressive figures.

Sign up now for the CNBC Investing Club to follow Jim Cramer's every move in the market.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com