The Federal Trade Commission on Tuesday filed a lawsuit seeking to block drug giant Amgen's $27.8 billion acquisition of Horizon Therapeutics, arguing that the deal would "stifle competition" in the pharmaceutical industry.

The FTC said that the deal would allow Amgen to "entrench the monopoly positions" of two of Horizon's fast-growing medications: the thyroid eye disease treatment Tepezza, and Krystexxa, which is a gout medicine

Specifically, the agency said, Amgen would be able to offer rebates on its existing drugs to pressure insurers and pharmacy benefit managers into favoring the two Horizon products, a strategy known as "cross-market bundling."

The FTC claimed California-based Amgen has a history of leveraging its drug portfolio to gain advantages over potential rivals.

The suit comes four months after Sen. Elizabeth Warren, a Massachusetts Democrat, in a letter to FTC Chairwoman Lina Khan asked the regulator to "heavily scrutinize" the acquisition, and the then-pending merger of Indivior and Opian, which she warned could lead to higher prices.

"Today's action – the FTC's first challenge to a pharmaceutical merger in recent memory – sends a clear signal to the market: The FTC won't hesitate to challenge mergers that enable pharmaceutical conglomerates to entrench their monopolies at the expense of consumers and fair competition," said Holly Vedova, agency's bureau of competition director, in a statement.

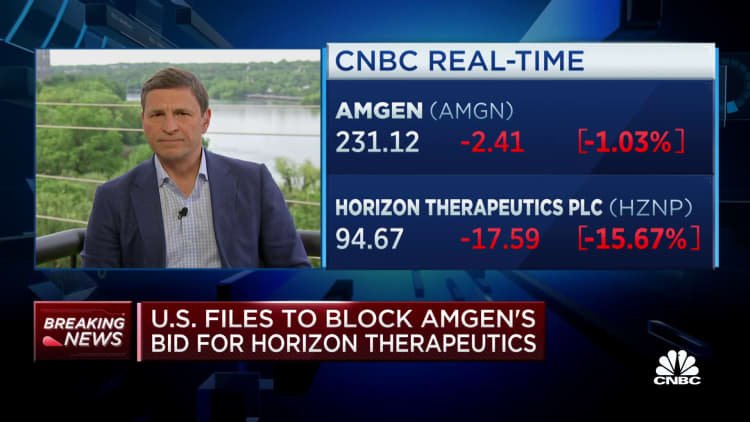

Horizon's share price closed 14% lower Tuesday. Amgen's stock price ended down by more than 2%.

Amgen and Horizon, which is based in Ireland, in separate statements said that they believe they will be able to complete the deal by mid-December after responding to the lawsuit in court.

Amgen said that it was "disappointed" by the FTC's complaint, and that the company believes it has "overwhelmingly demonstrated" that the merger poses no competitive issues.

Amgen "remains committed to completing this acquisition, which will bring significant benefits to patients suffering from very serious rare diseases in the U.S. and around the world," the company said.

The firm added it has been working "cooperatively" to answer questions raised by the FTC's investigative staff over the past several months.

Horizon said it "does not and has no plans" to engage in cross-marketing bundling.

The two drugmakers in February said that the FTC sent them a second request for information about the acquisition as part of the agency's review of the deal.

Amgen struck the deal to buy Horizon Therapeutics in early December and had initially said that it expected to complete the sale in the first half of 2023.

The purchase would strengthen Amgen's drug portfolio as it prepares to face several patent expirations for key treatments over the next decade. That includes a patent for a medicine that treats psoriasis, an autoimmune condition that causes inflammation of the skin.

Street sentiment

Despite the FTC lawsuit, Wall Street analysts on Tuesday remained optimistic about the acquisition closing later this year.

SVB Securities analyst David Risinger wrote in a note to investors that he believes the basis for the FTC's lawsuit is weak. The move to block the deal appears to be related to "general frustration" with pricing and rebating in the pharmaceutical industry, he said.

"There does not seem to be a strong rationale that the FTC can justify that this specific deal would be anti-competitive in nature, in our view," Risinger wrote.

Guggenheim analyst Michael Schmidt wrote in a Tuesday note that regulators will "continue to face an uphill battle in pushing new antitrust theories of competitive harm given the need to align with courts."

Schmidt pointed to recent court rulings that dismissed FTC challenges of other proposed deals in the pharmaceutical industry, including a ruling by a judge in September in favor of biotech company Illumina's acquisition of cancer test developer Grail.

The FTC moved to reverse that decision in April. But Illumina has appealed and believes it can prevail over the agency again.

Correction: This story has been updated to correct the spelling of Indivior.