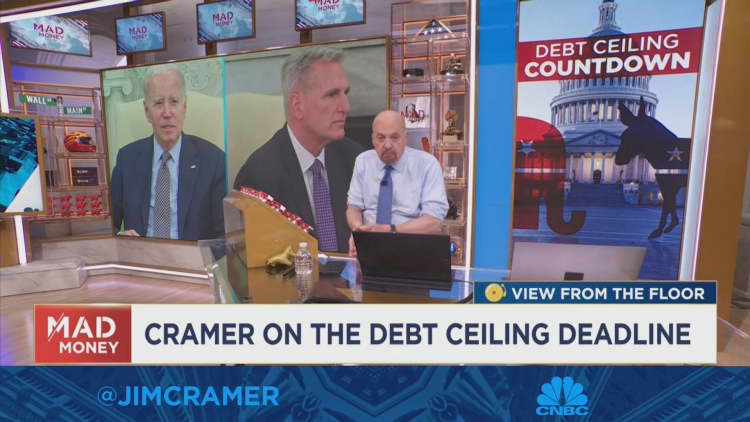

CNBC's Jim Cramer told investors on Thursday it was too early to get bullish on this market, even if lawmakers can cut a debt ceiling deal.

"I keep recommending you maintain a high-cash position, even if the Democrats and Republicans cut a deal, because last time it was the gut punch of the S&P downgrade a few days later that really crushed us," he said, referring to Standard & Poor's sharp drop after 2011's debt ceiling deal.

Cramer stressed that even though a deal was eventually reached in 2011, the market still suffered.

And so far, according to Cramer, this year's debt ceiling debacle is running parallel to that of 2011, making the S&P's past downgrade especially prescient.

"So, knowing what we know about 2011, it's premature to get bullish on this market," Cramer said. "Best to keep the cash on the sidelines and waiting."

Sign up now for the CNBC Investing Club to follow Jim Cramer's every move in the market.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com