The S&P 500 was little changed Wednesday as traders pored over the latest commentary on the pace of future monetary policy from Federal Reserve Chair Jerome Powell.

The Dow Jones Industrial Average fell 74.08 points, or 0.22%, to 33,852.66. The S&P 500 was lower by 0.04% at 4,376.86. Meanwhile, the Nasdaq Composite rose 0.27% to 13,591.75.

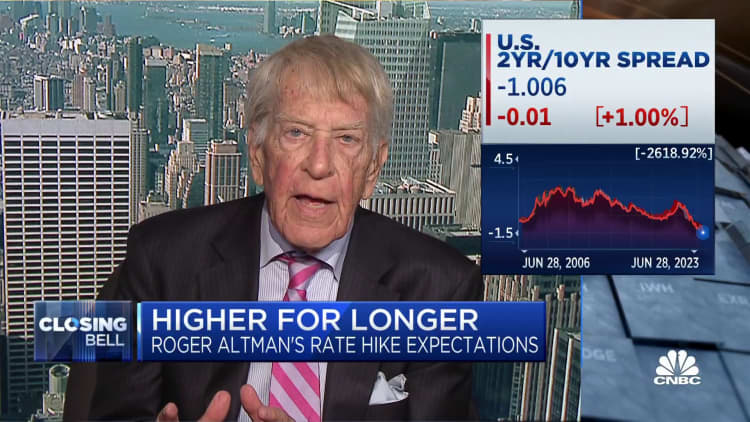

Powell on Wednesday said more restrictive policy is still to come as the Fed continues to fight inflation, including the likelihood of interest rate hikes at consecutive meetings. Powell spoke before a panel with Bank of England Governor Andrew Bailey, European Central Bank President Christine Lagarde and Bank of Japan Governor Kazuo Ueda at the ECB Forum on Central Banking in Sintra, Portugal.

"We're all digesting the comments from the big four central bankers," Bokeh Capital Partners' Kim Forrest said. "And it feels like the market really wants to go higher, but the whole, 'we need to have higher rates for longer' message is kind of serving as today's cap."

Chip stocks fell a day after The Wall Street Journal reported that the U.S. was considering new export restrictions to China. Artificial intelligence beneficiary Nvidia dropped by more than 1%, and the iShares Semiconductor ETF (SOXX) also declined.

Still, the Nasdaq Composite bucked the trend and closed higher for a second day. Google-parent Alphabet rose more than 1%, while Tesla jumped more than 2%. Netflix shares gained more than 3%.

Investors are preparing to close out the best first half for the Nasdaq in 40 years, as they ride a wave of optimism around artificial intelligence that has significantly buoyed a handful of mega-cap tech stocks. The S&P 500 and Nasdaq Composite are higher this year by 14% and nearly 30%, respectively.

— CNBC's Jeff Cox contributed to this report.

Correction: An earlier version of this story incorrectly stated the magnitude of the Dow's move on Tuesday.