Shares of Palantir closed up 11% Monday as the company continues to capitalize on investors' hopes for its artificial intelligence software ahead of its earnings report next week.

Palantir, a data analytics company best known for its work with the U.S. government's defense and intelligence agencies, offers a number of AI-powered services for organizations across public and private sectors. CEO Alex Karp said in the company's first-quarter earnings that demand for Palantir's new artificial intelligence platform is "without precedent," and shares of the company closed up more than 206% year to date.

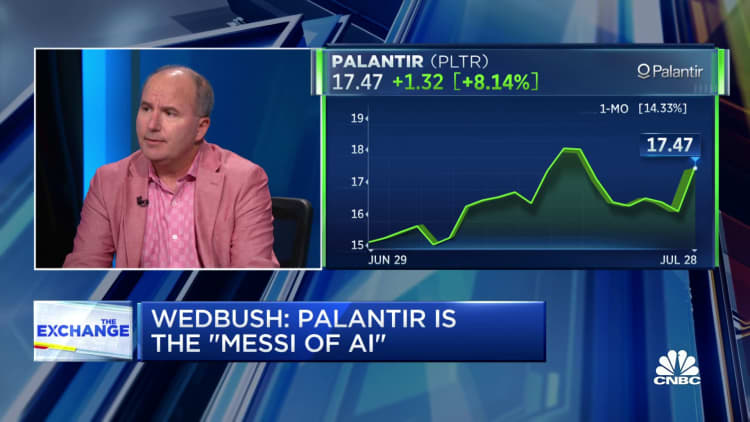

In an interview with CNBC's "The Exchange" Friday, Dan Ives, managing director of equity research at Wedbush Securities, described Palantir as "the [Lionel] Messi of AI," referencing the pro soccer player. Ives said there is a "golden path" for the company to monetize, adding in a note that Palantir has built "an AI fortress that is unmatched."

Wedbush Securities issued an outperform rating and a $25 price target on the stock Friday. Palantir closed at $19.84 per share Monday.

"We believe PLTR will capitalize on the expansion of new use cases over the next 6-12 months given its large partner ecosystem and extensive product capabilities, by servicing the rapidly increasing demand for enterprise-scale generative artificial intelligence," Wedbush analysts wrote in the note.

Karp acknowledged the frenzy around AI as well as the risks posed by the technology in an opinion piece in The New York Times Tuesday. He called for increased collaboration between the government and the tech sector, and wrote that attention should be "urgently directed at building the technical architecture and regulatory framework that would construct moats and guardrails around A.I."

Karp argued against the slowdown in research and innovation that many tech leaders called for, and he warned that if the U.S. does not invest in AI, other nations will.

"This is an arms race of a different kind, and it has begun," Karp wrote. Later, he added, "The ability of free and democratic societies to prevail requires something more than moral appeal. It requires hard power, and hard power in this century will be built on software."

Analysts at William Blair also increased their second-quarter revenue estimates for Palantir to $551 million from $529 million Monday, writing in a note that the company will likely experience a pull-forward from its SPAC customers that have declared bankruptcy.

The analysts said SPACs had a "significant positive impact on first-quarter earnings relative to consensus," and they expect that to continue in the second quarter.

Palantir is set to report second-quarter results on Aug. 7 after market close.