CNBC's Jim Cramer gave guidance on how investors can decide whether to put savings into Roth accounts. He explained that most of this decision has to do with how high you expect your income to get and whether you want to be taxed on your savings now or in the future.

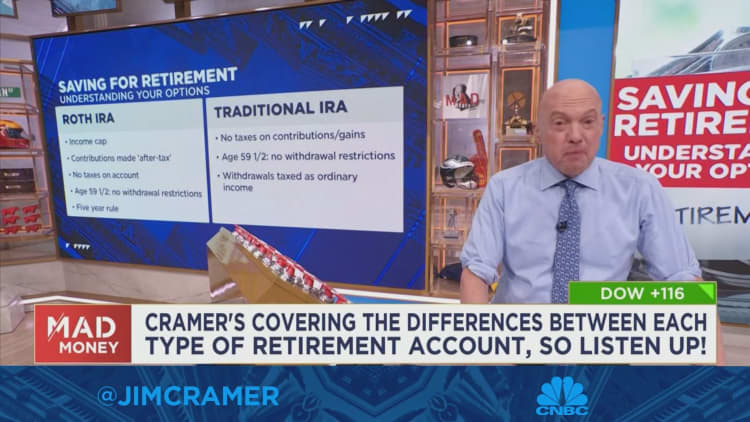

He focused on Roth accounts as they relate to two different retirement accounts: 401(k)s and individual retirement accounts, or IRAs. The primary difference between Roth and non-Roth accounts is that money in a Roth is taxed when you put it into the account, not when you withdraw it years later, Cramer said.

"When you're trying to decide between a Roth IRA or 401(k) and a regular IRA or 401(k), you need to determine whether it makes more sense to pay income tax now with a Roth, or to wait and pay income tax once you've retired, with a regular account," Cramer said. "In short, you're trying to figure out whether you'll be in a higher tax bracket after you've retired, or a lower one."

Cramer emphasized that there is no one-size-fits-all approach to this question, and some investors may be constrained to their employer's retirement account policies.

However, he stated a good rule of thumb for anyone whose marginal tax rate is less than 22% is to take the hit upfront and allow the account to compound tax free until retirement. Cramer also noted that Roth accounts let you withdraw money you've invested after five years without being hit with a 10% penalty.

"The lower your present income, then the lower your tax rate," Cramer said. "So, the less money you make, the more likely that a Roth is for you. It's that simple. And when you're saving for retirement, don't worry about what could go catastrophically wrong 30 or 40 years in the future — just worry about making the best choices right now."

Sign up now for the CNBC Investing Club to follow Jim Cramer's every move in the market.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com