Klaviyo is targeting a fully diluted valuation of up to $9 billion in its initial public offering after it raised the proposed price range of its shares in a filing on Monday.

The marketing automation company estimated in the filing that its IPO price will fall between $27 and $29, up from the $25 to $27 range it previously estimated. Klaviyo announced the launch of its IPO last week and plans to list shares on the New York Stock Exchange under the ticker "KVYO."

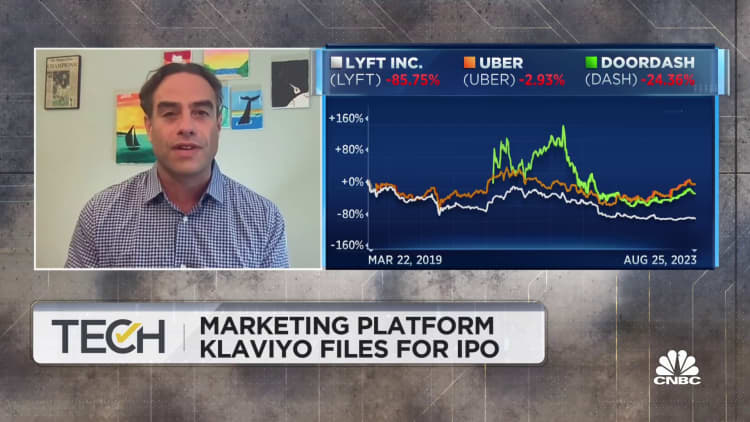

Klaviyo's IPO comes after a yearslong stretch of very few significant venture-backed tech offerings. It follows Instacart's IPO announcement and Arm's debut, showing an early sign that tech offerings could be making a comeback. Depending on how Klaviyo, Instacart and Arm perform, their IPOs could encourage other tech companies to follow.

E-commerce company Shopify owns about 11% of Klaviyo shares, the marketing firm disclosed, with about three-quarters of its annualized recurring revenue derived from customers who use Shopify, as of the end of 2022.

— CNBC's Annie Palmer contributed to this report.