CNBC's Jim Cramer on Monday considered how the market could broaden in the new year, saying fewer restrictions on mergers and acquisitions from the Federal Trade Commission could help spread the wealth beyond high-performing tech stocks.

"Mergers and acquisitions could be the potential savior for much of this market, everything from medical devices to industrials, to retailers, aerospace, utilities, foods and drugs and so many other groups," he said. "Right now, though, the FTC's really been very strong about blocking everything, trying to block any deal that comes in their way, sometimes just to hold them up before a judge lets them through, and sometimes successfully just shooting them down."

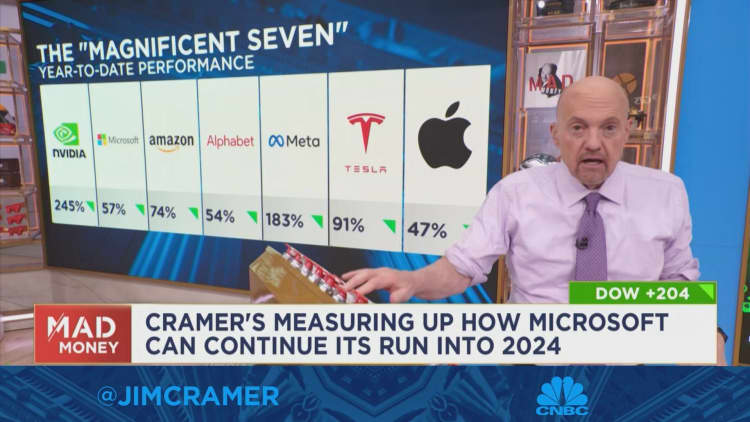

Cramer conceded that it has been a hard year for stocks other than those in the "Magnificent Seven," whose success has outshone most other sectors. The seven Nasdaq stocks are Alphabet, Apple, Amazon, Meta, Microsoft, Nvidia and Tesla. He said he's not sure if this dynamic can change in the new year, adding that either the "Magnificent Seven" need to "stop doing so many things right" or the others need to "stop doing so many things wrong."

Cramer said the possible solution for the rest of the market isn't necessarily about challenging the "Magnificent Seven," but changing the percentage gain of other companies. Cramer instead suggested mergers could lead to major gains in a variety of different sectors.

According to Cramer, pharmaceutical companies could see better and more profitable products if they were to merge or acquire biotech companies. Food companies need to merge to bring their costs down, he added, asserting that these deals won't lead to higher prices for the consumer. Cramer also said bank mergers could lead to gains for the target and the acquirer, saying there are currently too many banks to regulate well.

"If you want to see the rest of the market go higher, President [Joe] Biden just needs to replace his FTC chair, Lina Khan," Cramer said. "But given his pro-worker attitude and the fact that mergers often lead to layoffs, I doubt he'll go there. Then again, nobody lasts forever in these jobs, so you never know."

Sign up now for the CNBC Investing Club to follow Jim Cramer's every move in the market.

Disclaimer The CNBC Investing Club Charitable Trust holds shares of Amazon, Apple, Microsoft, Alphabet, Meta and Nvidia.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com