CNBC's Jim Cramer on Wednesday said the market hasn't been playing by usual Wall Street rules over the past few years, telling investors to find anomalies and use them to their advantage.

"Nothing we've ever learned about the market has played out like it was supposed to for the last two years," he said. "If we don't accept what's happened here, then I think we'll miss out on a lot of easily gettable wins, just like last year. When the market no longer reflects the playbook, you've got to throw out the playbook and write a new one."

Usually, homebuilders see losses during an aggressive tightening cycle, Cramer said. But despite the Federal Reserve's relentless rate hikes, stocks such as Lennar, Toll Brothers and PulteGroup have seen major gains compared to this period last year.

Cramer also pointed to Boeing's performance as an inconsistency. The company is facing heavy scrutiny after a piece of its 737 Max 9 aircraft blew out during an Alaska Airlines flight. Both Alaska and United Airlines said they'd found loose hardware on several Max 9 planes during inspections, and the Federal Aviation Administration said it would audit Boeing's Max production line.

Despite all of this bad news, Boeing's stock has recovered. Cramer said buyers will come out for any dip and attributed this move partially to an aircraft shortage, with airlines unable to find a manufacturer with Boeing's scale.

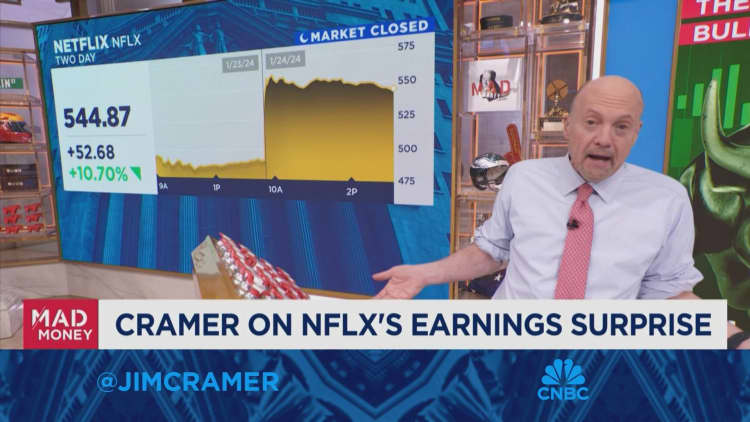

Cramer said investors may expect sell-offs in a narrow market, but this hasn't been the case. The market has continued to perform well despite its lack of breadth, with the "Magnificent Seven" — Apple, Amazon, Alphabet, Microsoft, Meta, Nvidia and Tesla — leading the charge.

"Let's just face it: We have a small group of incredible companies run by actual geniuses, not clowns, that are worth trillions of dollars, with big balance sheets that put some nation-states to shame," Cramer said. "And it's fine if they're the leaders."

Sign up now for the CNBC Investing Club to follow Jim Cramer's every move in the market.

Disclaimer The CNBC Investing Club Charitable Trust holds shares of Apple, Amazon, Alphabet, Microsoft, Meta and Nvidia.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com