CNBC's Jim Cramer told investors why he thinks the market was able to rally on Thursday, citing continued momentum in the tech sector and new inflation data suggesting the economy might be amenable to interest rate cuts.

"What mattered was the one-two punch of an economy that's just right—meaning still potentially ripe for rate cuts, it could happen—and the fact that AI is alive and well," he said. "It reminded us why you can't leave stocks, even if you think we've had a nice run so far this year and it'd be safer to move to the sidelines."

The Nasdaq Composite advanced to its first record high since 2021, popping 0.9% as tech and chip stocks saw gains. The S&P 500 also hit a new record, gaining 0.52%, while the Dow Jones Industrial Average inched up 0.12%.

Cramer pointed to figures from January's personal consumption expenditure price index, one of the Federal Reserve's key metrics when deliberating about interest rates. The report showed that inflation rose in line with expectations, and he was encouraged by these tepid figures, even if they don't necessarily signal imminent rate cuts.

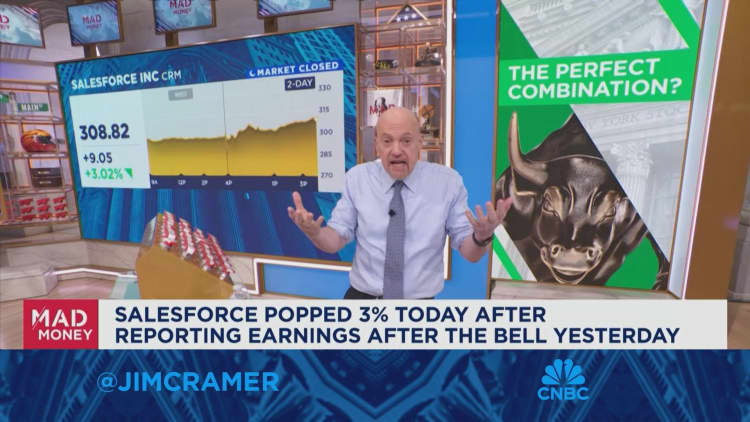

Wall Street had also been worried the artificial intelligence craze is winding down, Cramer said, with some especially disheartened by Snowflake's 18% drop spurred by weak guidance and its CEO's departure. Salesforce also issued a light forecast on Wednesday night, but the stock managed to recover and finished up about 3% on Thursday, bringing up other tech stocks with it, Cramer said. And a "usually tempered" Citi analyst indicated on Thursday he was bullish on semiconductors, which bodes well for AI stocks, according to Cramer.

These factors helped elevate the Magnificent Seven, Cramer said. He was further optimistic about the tech sector because Dell managed to soar in extended training after its quarter beat expectations and the company indicated there is high demand for its AI servers.

"Now, there were some laggards today, of course, I get that—there were plenty of safety stocks that weren't so safe," Cramer said. "That said, I wouldn't be surprised if the rally continues tomorrow given that the PC and server giant Dell shot the lights out after the close today—one more data point showing that tech's got a lot more strength than people think."

Sign up now for the CNBC Investing Club to follow Jim Cramer's every move in the market.

Disclaimer The CNBC Investing Club Charitable Trust holds shares of Salesforce and Apple.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com