In 2017, mighty winds blew in political storms as well as climate-related ones. Surprising election results, geopolitical unrest, and reports on climate change and income inequality drew media headlines, as well as investor attention.

We believe a growing imperative to address environmental, social, and governance (ESG) issues is being felt by businesses and investors alike, and that in 2018, the following trends will drive further growth in responsible investment strategies.

US political climate

Under the Trump administration, we have seen the U.S. exit the global Paris Agreement, largely dismantle the EPA, and roll back environmental regulations. In response, more states, cities, companies and universities have taken up the banner of reduced carbon emissions and clean energy, forming groups like the We Are Still In Coalition.

For investors, directing money to ESG strategies and companies with responsible practices and policies is a way to vote with their dollars. If people can't rely on the federal government to prioritize issues such as clean water, living wages or diversity, there is recognition that more companies are doing so for sound financial and business reasons.

Among the U.S. Fortune 500, for example, 240 companies (nearly 48 percent) have set renewable energy or carbon-reduction targets, as reported in Power Forward 3.0, and cite significant cost savings from these efforts.

Proliferation of ESG products

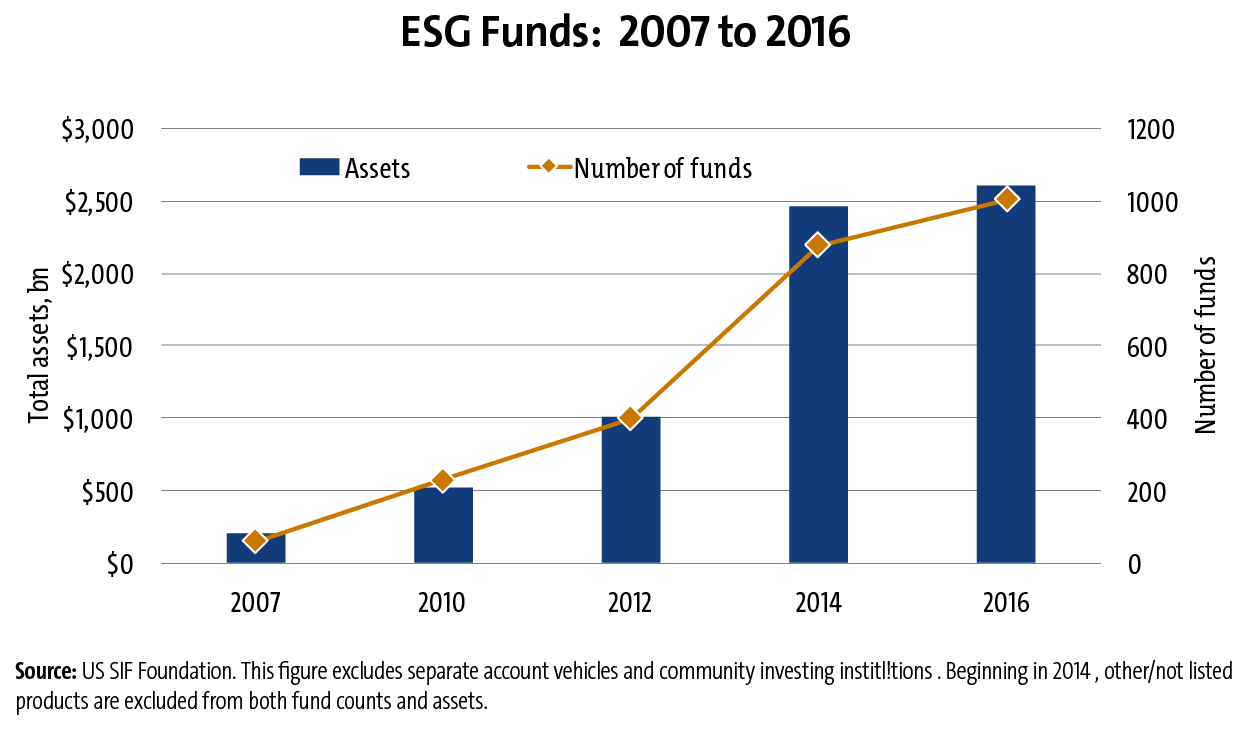

As interest in responsible investments has spiked across the retail, institutional and retirement 401(k) channels, so has the number of ESG product offerings.

In the U.S., the number of investment products with ESG criteria — including mutual funds, ETFs and variable annuities — has compounded by 29 percent a year since 2010, according to The US SIF Foundation.1