Before converting a traditional IRA to a Roth IRA, consider two tax-savvy strategies.

Key takeaways

- Consider spreading the cost of a conversion over a few years.

- Consider making a charitable contribution to offset the tax cost of a conversion, and using a donor advised fund.

- Managing the tax impact of a Roth IRA conversion requires careful analysis. A review with a financial or tax adviser is a good idea.

The benefits of a Roth IRA are clear — the potential for tax-free growth and tax-free withdrawals.1 But not everyone may be able to contribute to a Roth IRA because of IRS-imposed income restrictions on contributions. But anyone can convert existing money in a traditional IRA or other tax-deferred retirement savings account to a Roth IRA. And many do.

A Roth IRA conversion does have a cost. Income taxes need to be paid on the converted amount. Taxes are "front-loaded," which allows the money in the Roth IRA to grow tax free. It also provides tax-free withdrawals for the Roth IRA owner or his or her heirs.

Here are two ways to help manage the taxes, one of which combines the conversion with a charitable deduction.

Spread the cost

A common way to manage taxes on a Roth IRA conversion is to spread the conversion over a few years. This spreads the taxes too, and it may also prevent the income from the conversion from causing a bump into a higher tax bracket.

Consider this hypothetical example: Imagine a married couple, the Mullens, who expect to file jointly with $100,000 in taxable income. They could convert up to $50,000 to a Roth IRA and stay within their current tax bracket, which applies to taxable income between $90,000 and $150,000. (Note: This is a hypothetical bracket for this simplified example only; actual tax brackets will differ, and they may change from year to year). As long as their tax rate and income generally stay the same, they could convert this amount yearly until they reach the total amount they want to convert. The potential benefit is that they maintain a consistent tax rate when converting (provided their situation and the tax rates don't change in the ensuing years.) If they converted more than $50,000, any amount over the current marginal rate income range would be taxed at the next higher marginal rate.

However, things aren't always as simple as they are in this example. Managing the tax impact of a Roth IRA conversion requires careful analysis. A review with a financial or tax adviser is a good idea.

Other things to consider

A conversion must be completed by December 31. Estimating taxable income can be tricky without all tax reporting documents, which aren't typically available until late January, at the earliest, of the following year. So, your estimated taxable income may end up being higher or lower than expected.

Another challenge: For those near the top of their bracket, it may take a long time to convert the total amount wanted without moving into a higher bracket. For example, for joint filers with $100,000 taxable income, the next bracket begins at $150,000. Converting only $10,000 would keep the filers within the same bracket.

Consider a charitable contribution

Tax deductions can help offset the tax cost of a Roth IRA conversion and perhaps allow conversion of a larger amount at a lower tax cost. Among the more flexible of deductions, especially for high-income earners, are charitable contributions.

The tax deduction for a contribution to a public charity can be up to 60 percent of adjusted gross income (AGI) for cash donations and up to 30 percent for donations of securities (generally deductible at fair market value when long-term appreciated securities are gifted) in a given year. And if a contribution exceeds these limits, the excess can generally be carried forward for up to 5 years. (Note: These limits are generally applicable, but there are exceptions, and the rules are complex. Consult a tax adviser when considering a large charitable contribution.)

The amount of the charitable deduction available to claim can generally be estimated by adding the taxable portions of a conversion amount to AGI. For example, for those planning to convert $200,000 to a Roth IRA, with a $150,000 AGI before the conversion, the estimated AGI would be $350,000 after the conversion. Up to $210,000 (60 percent of $350,000) of charitable cash contribution or $105,000 (30 percent of AGI) of a charitable donation of securities with long-term appreciation, could potentially be deducted. This could significantly reduce the tax impact of a conversion.3

An example

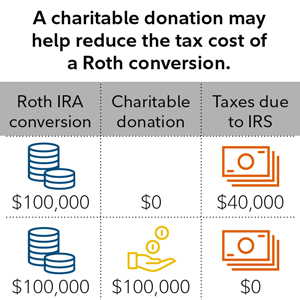

A charitable donation may help reduce the tax cost of a Roth conversion.

Gifts to charity are irrevocable and nonrefundable. This is a simplified hypothetical example for illustrative purposes only. Tax results can vary greatly depending on an individual's tax situation. Other strategies may provide more flexibility and similar savings, including utilizing other deductions and/or converting assets to a Roth account over several years. Please consult a tax adviser.

Consider this hypothetical example (shown right): Richard and Ellen Nettle are considering a large Roth IRA conversion. They have $500,000 in an eligible rollover IRA and $500,000 in a taxable brokerage account — which could be used to pay the taxes on the conversion, or to make a charitable donation. The couple expects that in the coming years their income will be higher, pushing them into a higher tax bracket, so they'd like to convert $100,000 from their rollover IRA at the lowest possible tax cost as soon as possible. The Nettles regularly give to charity and could make a $100,000 one-time gift to charity this year from their taxable brokerage account. The couple expects $350,000 in AGI this year. If they made a charitable contribution of $100,000 of securities from their taxable brokerage account, they could deduct it from their income. The Nettles' combined federal and state/local income tax rate of 40 percent would apply to the $100,000 Roth conversion, so it would cost them $40,000, which they could offset entirely with their $100,000 contribution.

So the Nettles could save $40,000 in taxes if they make a charitable donation the same year they convert. However, they would need to be able to afford the $100,000 charitable donation — an important consideration. On the other hand, if the $100,000 that the Nettles gave to charity included securities with long-term appreciation, by gifting the securities, the Nettles would also avoid taxes on the realization of those gains.4 In some cases that can significantly reduce the effective after-tax cost of a charitable contribution.

This is a simplified example. It's important to speak with a tax adviser as part of a Roth IRA conversion decision, particularly if you are contemplating a charitable contribution at the same time.

Consider a donor-advised fund

What if someone prefers giving regularly rather than making a single large gift to charity when he or she converts to a Roth IRA? It may make sense to consider a donor-advised fund, or DAF. DAFs, which are programs offered by public charities, allow a charitable contribution to be made in a given year, and they provide a tax deduction for that year. Then, at a later time, grants can be recommended from the DAF to the charities a person wishes to support. The tax deduction can be taken in the year the Roth conversion was done to help offset the conversion taxes. With a DAF, a "ready reserve" of charitable dollars is front-loaded that can be used over time to support many charitable causes.

Conclusion

Charitable deductions may be worth more if taxes go up in the future, because they may be deducted against a higher tax rate. Also keep in mind that gifts to charity are irrevocable and final.

Managing the tax impact of a Roth IRA conversion requires careful analysis. Ideally, it should include a review with a financial or tax adviser to fully investigate the benefits from a Roth IRA conversion and how to execute it appropriately.

Next steps to consider

Get started on your own or get help from our investment professionals.

See how helping charities can also maximize tax benefits

Read Viewpoints®: Answers to common Roth conversion questions

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

- A distribution from a Roth IRA is tax free and penalty free provided that the 5-year aging requirement has been satisfied and at least 1 of the following conditions is met: you reach age 59½, die, become disabled, or make a qualified first-time home purchase.

- To be eligible to recharacterize, you must file your taxes or an extension by the April 15 deadline.

- This does not take into account any limitations on itemized deductions or personal exemptions for taxpayers in higher tax brackets.

- The 60 percent limit on cash contributions and 30 percent limit on security contributions to 501(c)(3) public charities is an aggregate limit as a percentage of a taxpayer's adjusted gross income (AGI). Gifts to charity are irrevocable and nonrefundable.

Find helpful guidance, tools, and services to assist you as you prepare for retirement on your terms. See more Fidelity Retirement Viewpoints.

Fidelity does not provide legal or tax advice. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation.

Fidelity Charitable is a registered service mark of FMR LLC.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

557973.12.3