Given growing investor demand and understanding of the impact potential within fixed income, as well as issuer interest in addressing climate change, we continue to see an expansion of investment opportunities that meet double bottom line objectives.

Real estate: Sustainability will fare better in the long run

Improving the sustainability performance of real estate improves the attractiveness of the asset, keeps service charges lower, and reduces operational costs for occupiers. The transition to the low-carbon economy is now recognized by the business community as a certainty. The questions to ask are about the pace of that change and who the winners and losers will be as we undergo this transformation.

Real estate represents roughly 40 percent of global carbon emissions, so it is a significant part of the current problem and also part of the potential solution. The emergence of the "net zero building" is continuing to be the next frontier of good real estate investments.

Net zero buildings are generally accepted to mean buildings that are highly energy efficient, with all remaining operational energy use from renewable energy. There is mounting evidence that these buildings are easier to sell, more attractive to tenants, and less vulnerable to obsolescence. It is evident that these buildings are good investments that will ensure the best returns and remain "future proof."

Real assets / natural resources: The threats and opportunities of climate change to farmland investments

We all need food to survive — and we have very advanced agriculture to generate this food. However, there are two major things happening that we can't ignore.

1. In 30 years, we'll have another two billion people to feed, so there is a greater demand for more agriculture.

2. Climate change is making it much harder to grow food when you have severe storms, floods, wildfires and droughts.

Nuveen is the No. 1 global farmland investor, and we're very focused on how climate change affects a farm's productivity and value over the long term. It's not about sacrificing near-term performance — it's really about preparing, at the same time, for performance in tomorrow's world.

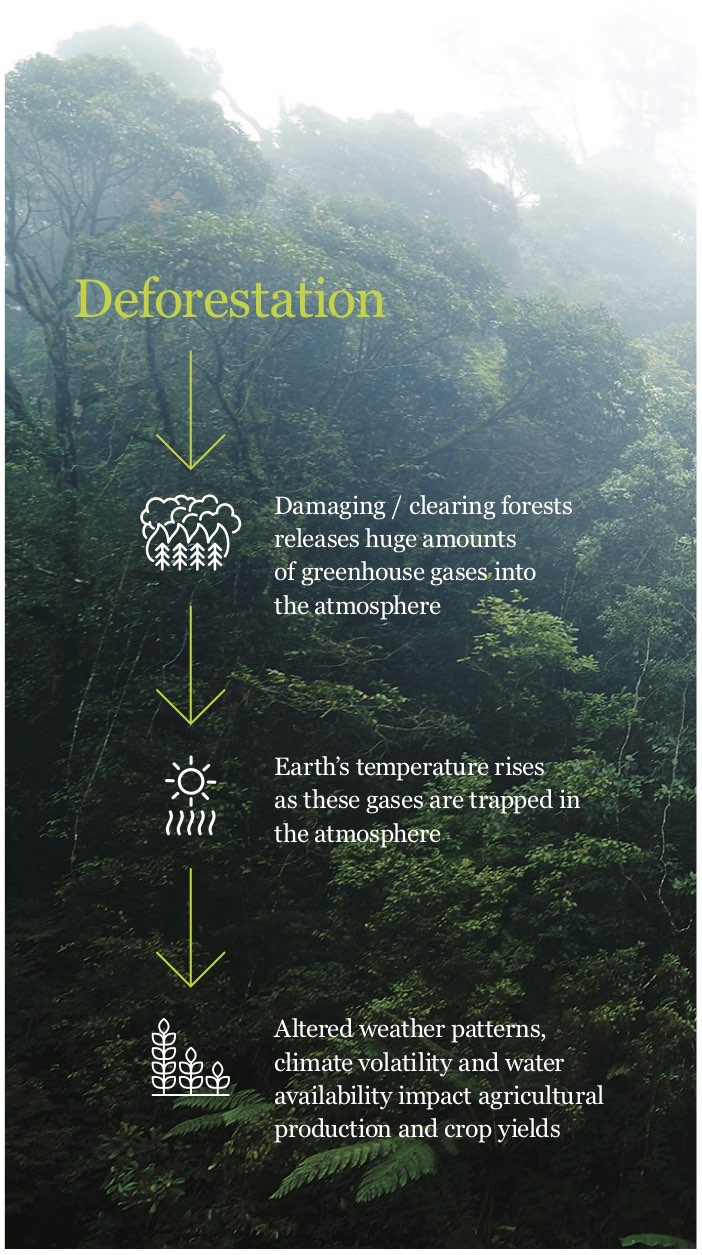

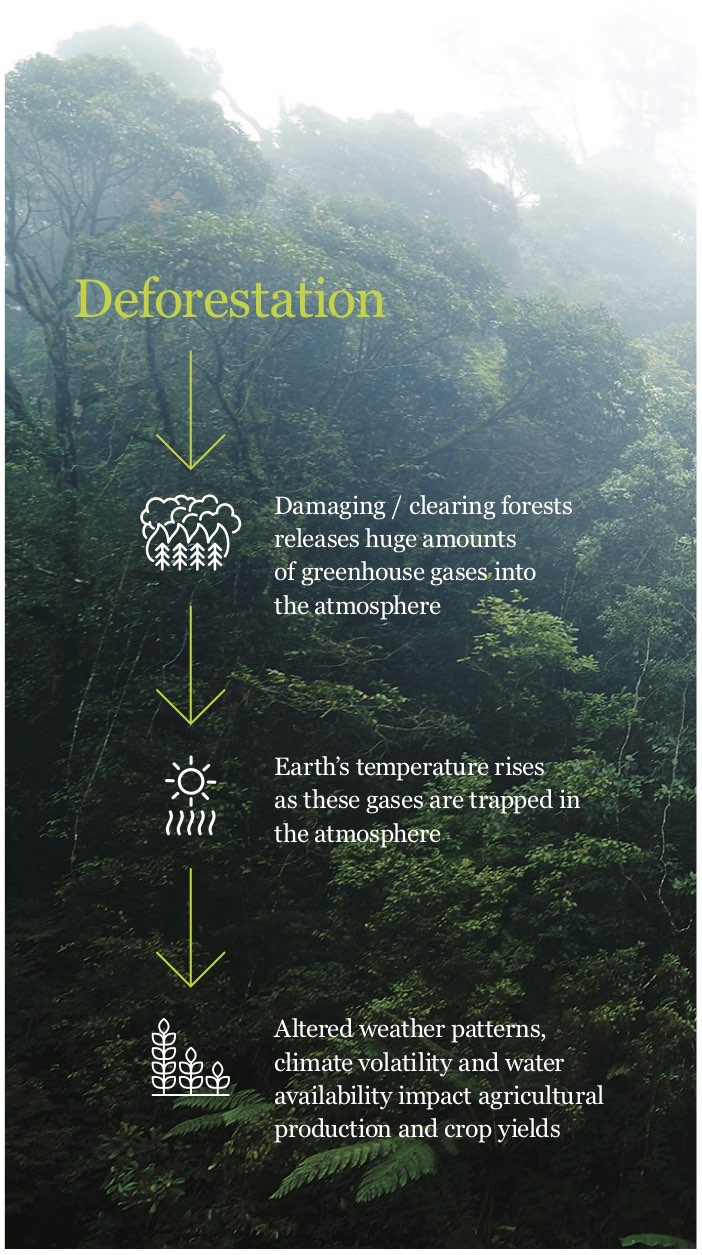

Sustainability is critical to maintaining long-term value for shareholders, because a farm has to be cultivated, tended to and protected if it's going to keep producing food and material year after year. One key threat to agriculture — really, to everyone on the planet — is deforestation, which creates about 15 percent of CO2 emissions globally. Deforestation in tropical areas is a particular concern because every minute about 40 football fields of tropical trees vanish. That is why we're committed to discouraging deforestation through a Zero Deforestation Policy for our Brazilian farmland investments. We think a Zero Deforestation Policy will add long-term value for our agriculture investments.

We are long-term investors. Therefore, we are relentless in giving voice to the long-term perspective — and it's critical to look at investments through the prism of climate change. We believe good ESG practices can add alpha and reduce risk — and create a better world.

This material is not intended to be a recommendation or investment advice, does not constitute a solicitation to buy, sell, or hold a security or an investment strategy, and is not provided in a fiduciary capacity. The information provided does not take into account the specific objectives or circumstances of any particular investor, or suggest any specific course of action. Investment decisions should be made based on an investor's objectives and circumstances and in consultation with his or her advisors.

Investing involves risk; principal loss is possible. There is no guarantee an investment's objectives will be achieved.

Nuveen provides investment advisory solutions through its investment specialists. 831907-R-O-04/20