That sentiment was echoed earlier Thursday by hedge fund titan Ray Dalio, who sees 2013 as a year where investors are ready to put cash to work in the markets. Dalio, who founded the hedge fund Bridgewater Associates, predicts that cash will flow into financial assets as well as economy—boosting goods and services.

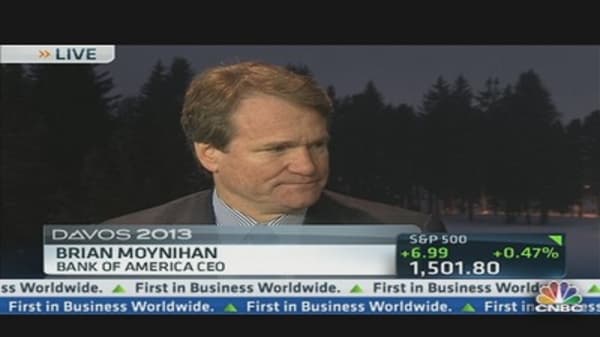

Moynihan said that BofA's own investment banking arm has already been performing well. "As uncertainty comes out of the system, firms will be more aggressive with acquisitions," he said.

The firm is "largely done" with downsizing in its investment banking division and head count is growing in consumer-facing bank positions, he said.

The bank also is meeting the increased capital requirements under the international banking rules of Basel III. "We don't need to raise any more capital," he said.

A day after JPMorgan's Jaime Dimon criticized policymakers for overcomplicating the business environment with new rules and regulations, Moynihan was less critical. He said he "doesn't see big changes to the business."

Moynihan wouldn't comment on whether he would use the bank's cash reserves to increase the dividend or do a share buyback. Any decision, he added, would be announced in March.