His bullish stance on bank stocks also comes in the face of tighter regulations on the industry. "You've had virtually every negative development that you could throw at this industry occurring. But in that four year period ... you went to all-time record earnings."

(Read More: 4 Banks to Buy Now)

Another factor working against the banks is near-zero interest rates. Describing himself as a supporter of Fed Chairman Ben Bernanke, Bove actually blasted the central bank's policy. "They've cut interest rates to a level which is crippling bank earnings to some degree and which is crippling the economy."

(Read More: No Risk of Higher Interest Rates This Year: Pro)

He said that low interest rates are hurting people who depend on "passive sources" of income. "They've taken away a staggering amount of money from the elderly population of the United States and put a whole bunch of them on food stamps," he said.

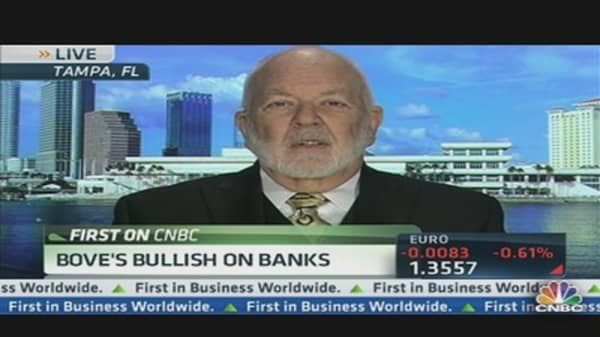

Last week, the former Rochdale Securities analyst Bove released a wide-ranging analysis on why investors should buy banks. It was his first research note since joining Rafferty.

(Read More: Banking to See 14-Year Run Higher: Dick Bove)

In his report and again in Monday's CNBC interview, he said, "If you had purchased bank stocks ... before the financial collapse, and you bought them at the same amount of money, every week for the last four, four-and-a-half years. You actually made money in virtually every major bank in the United States."