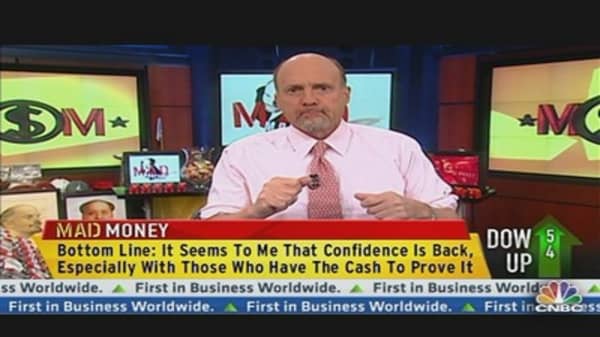

Although the price of gold fell near a six-month low on Tuesday, holding just above $1,600 an ounce, "Mad Money" host Jim Cramer continued to recommend investors have a position in the precious metal.

The yellow metal fell 0.5 percent as investors were drawn to riskier assets as the S&P 500 climbed to a five-year high with a string of recent merger activity suggesting stocks could offer even more value. Technical weakness has put downward pressure on gold, too.