Over the past month, since the time of the last Fed meeting, Cramer thinks the environment has changed significantly. For example:

- There's fear that sequestration is going to slowdown the economy.

- A leaked Wal-Mart memo suggests the retailer may be having its worst February in years. The Street has interpreted it to mean the end of the payroll tax holiday is hurting consumer spending, broadly.

- Toll Brothers missed Street estimates, which the Street fears is a sign that the housing renaissance has stumbled, especially at the high end

"Do you think this Fed, which has aggressively stimulated the economy, is going to take the foot off the gas pedal, now? "Think about it!" Cramer said.

The Mad Money host believes the Fed is keenly aware of these and similar developments.

------------------------------------------------------------------------

Read More from Cramer:

Don't Get Suckered Into These Stocks!

Is Air Going Out of This Market?

Cramer: This Decliner Could Bounce with a Vengeance

------------------------------------------------------------------------

"Perhaps, just perhaps, the Fed won't stop easing at the identical time when the sequester kicks in – and when the Street is worried that the housing market is on pause," he said.

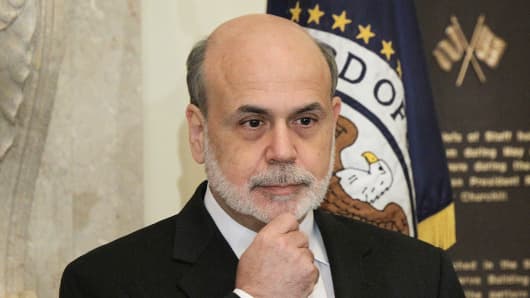

Also Cramer reminded that the Fed chief has said the central bank would remain aggressive until it met its goal of 6.5% unemployment.

The Mad Money host just doesn't think the thinking inside the Fed has shifted so much that Ben Bernanke and company would end stimulus programs in the face of these brewing headwinds.

"In other words, these minutes are causing people to flee the market, but they may not reflect the current thinking inside the Fed. Remember, the Fed has been very forward looking about the hazards coming," Cramer said.