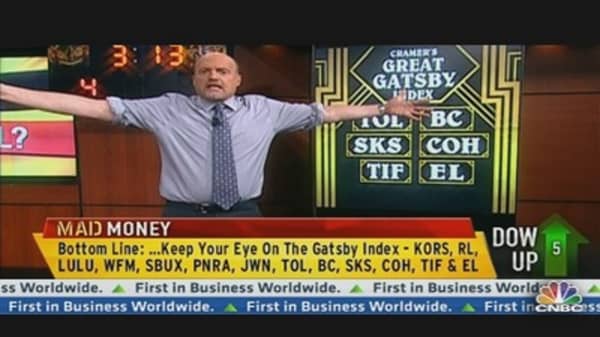

Panera Bread

"I know, Panera Bread is probably not the first thing that comes to mind when you think of high society, but it is the Gatsby of the quick-serve space, especially in comparison to the proletarian McDonald's or the college beer oriented Buffalo Wild Wings," Cramer said.

In February he said, "They are best in class when it comes to consistency. Plus, Panera still has room to expand—they're increasing the store count by roughly 8% per year. This is a fabulous growth story."

Starbucks

Cramer calls Starbucks a play on the Gatsby-fication of the developing world. "China is already well on its way to becoming Starbucks' second largest global market in 2013, and the company still has a massive amount of room to expand in the People's Republic. Yep, even communist China is full of aspirational coffee drinkers."

Toll Brothers

Toll Brothers has been one of Cramer's favorite plays on the housing recovery. "And make no mistake, this is a luxury homebuilder—the average selling price for a Toll house is nearly $570,000."

In January Cramer recommended this stock among others as a way to play the renaissance in housing.

------------------------------------------------------------------

Read More from Mad Money with Jim Cramer

Cramer Grow's Cautious, Says Buyers Should Wait

Cramer: 3 Stocks About to Play Catch-Up

After 2000% Gain, Now What?

------------------------------------------------------------------

Brunswick

"Brunswick belongs in the Gatsby Index because this is the number one maker of boats in the world, and a yacht or a motorboat is as discretionary as it gets," he said.

Saks

"Saks is the quintessential high end department store. And in their latest conference call, Saks said that the high-end is stabilizing, with the boost from the wealth effect offsetting the impact of higher taxes."

Coach

The rich as well as people who hope to become rich, shop Coach. Of all the stocks in the Gatsby Index, this one may be the most difficult to anticipate. Coach products are always fashionable but the stock, however isn't.

"I've come to think of Coach as a company that, over the last year, has made the difficult transition from being a growth to a value stock," Cramer said.

Tiffany

"Tiffany, the renowned jewelry retailer, is another one that had a tough year in 2012, but unlike Coach, Tiffany has been roaring since the beginning of 2013 even after the company reported disappointing holiday sales at the beginning of January," Cramer said.

Estee Lauder

Cramer called this maker of beauty producer the premier player in the cosmetics industry. "Estee Lauder's leading positions in all sorts of prestige beauty products have allowed the company to transcend its overall category, with earnings growth in the mid-teens and a stock that's only a point and a half away from its highs."

Call Cramer: 1-800-743-CNBC

Questions for Cramer? madmoney@cnbc.com

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com