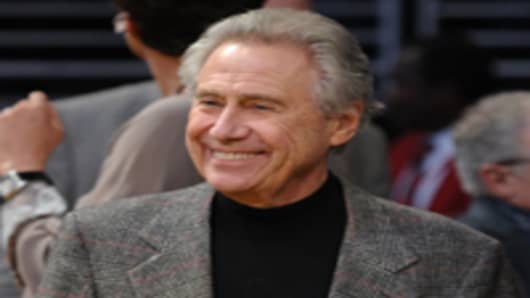

The deal, which he said "from the beginning had less than 50-50 chance of happening," drew non-biding bids of more than $1 billion less than the $8 billion people close to the process said Anschutz was seeking.

The sale process, which the company acknowledged on Sept. 19, was closely watched for its world-class assets and lofty price tag. AEG's portfolio includes 120 owned or operated arenas around the world, the Los Angeles Kings professional hockey team, a stake in the Los Angeles Lakers basketball team, and a concert business.

It had drawn second-round bids by Colony Capital, Guggenheim Partners, and Los Angeles biotech billionaire Patrick Soon-Shiong, people familiar with the deal process told Reuters.

AEG hired Blackstone Group, which last year handled the sale of the Los Angeles Dodgers baseball team, to help find a buyer.

Anschutz wouldn't discuss the bids other than to say they were not so low that he couldn't have negotiated and "got there" to sell the company.

Rather, the dealmaker — who built companies in oil, railroads, and telecommunications — said he worried that a potential buyer would rip apart what he called "the power of the model" that he built at AEG.

"At its heart it's a real estate model with some sexy things bolted onto it," said Anschutz. "I just didn't want someone changing what we had built."

Anschutz said he intends to put more capital into AEG and to search for new business opportunities. Among AEG's existing priorities, he said, are a planned $1.2 billion football stadium in Los Angeles to lure a National Football League franchise, and an arena in Las Vegas the company intends to build with casino operator MGM Resorts International.

After deciding to take AEG off the market, Anschutz named Dan Beckerman president and chief executive officer of AEG, replacing Tim Leiweke, who has been at the helm since 1996 and is leaving the company.

Leiweke was the public face of many of the company's project ventures and Anschutz said "it was a mutual decision" for him to leave.

"We really like Tim and what he did for the company," said Anschutz. "He was always focused on new deals. We need to get back to our business, and I think we can both do that and look for new opportunities."

A call to Leiweke's office wasn't returned and an AEG spokesman was unavailable to comment.