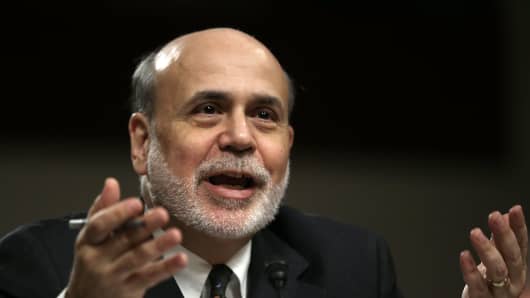

If it sounds like Federal Reserve Chairman Ben Bernanke is dancing in his testimony, it's because he is doing rhetorical figure eights in trying to signal where the Fed is going.

Here are the cones he is attempting to skate around:

Forward guidance: the Fed is trying to use this tool to help the economy, trying to convince markets the Fed will be aiding the economy for a long time,even after the economy strengthens. A signal of imminent tapering would diminish that tool by prompting the market not only to anticipate that tapering, but future tightening of policy.

The terminal rate: the problem for the fed is also one of degrees. Let's say it adjusts its view from the current $85 billion worth of asset purchases to but $45 billion, determining that as the right amount of accommodation for the economy right now. A $40 billion reduction in quantitative easing could prompt the market to price in no QE, or the end point of policy, sooner than the Fed wants.

The Fed would like the ability to reduce QE, yet not have the market price in an imminent end to bond buying.

Bubble/Bubble Popping avoidance: the Fed wants stocks to be higher, but worries about financial instability and over leverage. That's on the way up. On the other hand, the Fed does not want the market to be taken by surprise if it ends up reducing QE. Obviously, a sharp sell-off would have negative consequences for the economy.

So Bernanke is trying to make clear QE is not going away imminently to capture forward guidance benefits. Still, he's trying to keep the market on its toes by making it aware that a QE reduction could happen in the next few meetings if the data show sustainable improvement in the labor market.

Finally, he is making clear that a reduction in QE is not a tightening in the Fed's view. His argument seems to be that even if the Fed buys fewer assets, it will still be growing its balance sheet. And if it buys none, it will still have a very large balance sheet.