The U.S. Federal Reserve is likely to act soon to quell investor panic over the potential tapering of its bond-buying program, Fed watcher Jon Hilsenrath wrote in the Wall Street Journal late on Thursday.

Speculation over whether or not the Fed will pullback its $85 billion a month bond-buying program and the timing of that, has led to volatility in global markets, particularly within Asia. Japan's Nikkei, for example, has plunged near 20 percent from its five-and-a-half year high hit on May 23.

(Read More:

Are Markets Facing a Crisis of Confidence?

)

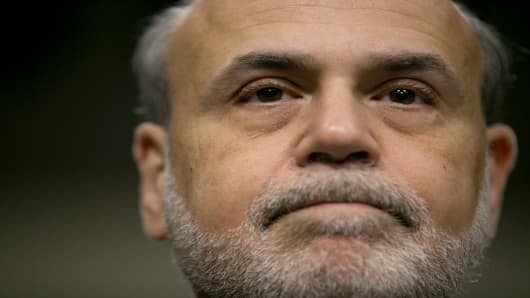

The Fed meets next Tuesday and Wednesday and according to the Wall Street Journal article, Fed Chairman Ben Bernanke will use the opportunity to reiterate that there will be a considerable period of time between the end of quantitative easing (QE) and raising short-term rates, a point he made in March.

"The chatter about pulling back the bond program has pushed up a wide range of interest rates and appears to have investors second-guessing the Fed's broader commitment to keeping rates low," wrote Hilsenrath.

"This is exactly what the Fed doesn't want. Officials see bond buying as added fuel they are providing to a limp economy. Once the economy is strong enough to live without the added fuel, they still expect to keep rates low to ensure the economy keeps moving forward," he added.