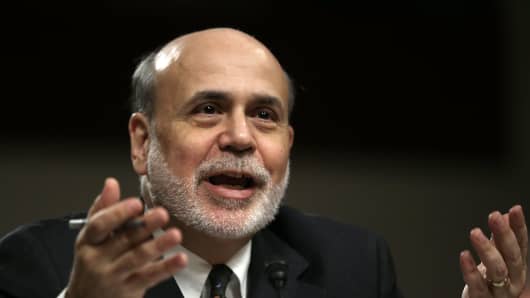

Taper Tantrum! I said this morning that it was easier to predict what Ben Bernanke will say than what the market will do, but that many traders felt stocks would drop no matter what was said.

Sure looks to be the case. The FOMC statement was virtually the same as the May 1 statement, with one exception: instead of saying "The Committee continues to see downside risks to the economic outlook," the sentence reads: "The Committee sees the downside risks to the outlook for the economy and the labor market as having diminished since the fall."

The phrase "as having diminished since the fall," has sent bond yields up and stock prices down, since it implies a stronger economy.

Mr. Bernanke continued the theme into his press conference, stating again that if economic conditions continue to improve, the Fed will begin tapering its bond purchases at the end of the year.

He did put a little more flesh on the bond tapering plan: may gradually reduce purchases later this year...will continue to reduce purchases through next year...may end in the middle of next year...will end purchases when unemploymentis near seven percent.

But time and again he emphasized the pace was data dependent: if conditions improve faster than expected, reduction in bond purchases can accelerate. If conditions worsen, purchases could even increase.

One thing's for sure: every time we get a positive payroll report it will start the tapering conversation. The June Nonfarm Report will be out July 5.

Now, will the adults take over? If the Fed is right, the economy is continuing to improve. They are not worried by low inflation readings, which they view as "transitory." The key 6.5 percent rate looks closer: they have moved it to the lower end of the 2014 forecasts, instead of 2015.

All this is good news: the economy is improving. Why is the bond market over-reacting? Because they believe diminished tapering means higher yields. I agree, but to what extent?

One final point: Bernanke did say they would hold on to their mortgage-backed securities, which he had not said before. That is a positive for mortgage rates.