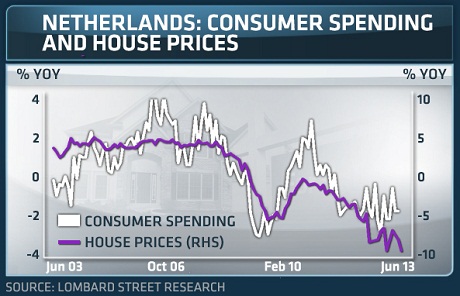

The Netherlands - home to the most indebted households in the euro zone - is undergoing a severe housing correction which will further dampen consumer spending and extend the country's recession, according to Michael Taylor, an economist at Lombard Street Research.

"Going Dutch", a term used to indicate that each person pays for himself, may be associated with frugality. But recent data shows that households in the Netherlands have been anything but frugal.

The country has the highest total household debt-to-income for the seventeen countries that share the euro, according to Eurostat. At more than 250 percent, it far surpasses the same figure for Ireland, Spain and Portugal.

Surging house prices in the country have now given way to a "painful post-bubble adjustment", Taylor said, similar to the adjustments in Spain and Ireland.