Weak emerging market data released over the past few weeks has prompted JPMorgan to reaffirm its view that it is too early for investors to pile back into the region.

Instead, the brokerage advised investors to hold more European assets than are represented in asset-allocation benchmarks.

JPMorgan has focused its investment on being "underweight" emerging markets against developed markets, across all asset classes, as the consensus outlook solidifies around slowing growth in developing economies.

(Read more: Is Asia poised for a sharp slowdown?)

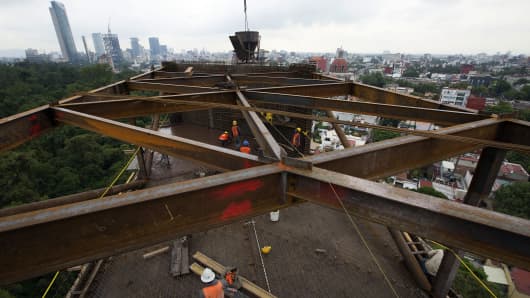

While much commentary and analysis has focused on China, the world's second-largest economy which is set to grow this year at its weakest pace since 1990, JPMorgan's note highlights that just this week, the firm cut its exposure to Mexico and Russia.

The note says that policy makers in these countries will not provide support as the slowdown gathers pace, due to inflation remaining too high or because of pressure on the currency preventing central banks from easing rates.

The note said that it would not be underweight emerging markets forever, and that a bettering performance from developed markets "should pull EM out of its funk."

A flurry of data out of China on Friday painted slightly more upbeat picture of the country's economy, with government figures showing industrial output jumping 9.7 percent in July, beating a market forecast by Reuters of 9 percent gain and higher than the 8.9 percent rise in June.

(Read more: Take heart: upward revisions to US growth on the way)

Another region of disappointment is Japan, with JPMorgan overweight the country's equities versus emerging markets since November 2012. Whilst performing well initially, JPMorgan has lost money the last month, with data emanating from Japan proving a disappointment against its more bullish expectations.

"We cut 2013 Japan growth from 2.2 percent to 2.0 percent today," the note read, adding, "This is largely position management as we remain long-term bullish on Japanese reflation and equities."

(Read more: Greek economy improves, bailout questions remain)

When it comes to Europe, JPMorgan is content with its overweight exposure, especially with supportive data coming through.

JPMorgan praised "more monetary policy support and a move from destructive austerity" from European governments, but did caution the level of economic strength in Europe: "We note that this does not mean that Europe will become an economic locomotive, as supply-side economics and macro stimulus are sorely missing."