Frozen yogurt shops have become like Starbucks in many big cities and college towns—they're on seemingly every corner.

But there's a bigger reason for the explosion of storefronts such as Pinkberry and Red Mango. Major American private equity firms—which specialize in spotting trends early and investing in smaller businesses set to explode—have poured money into the franchise-friendly industry since 2007. So far the strategy has worked, and a surge of new locations across the country has made frozen yogurt bigger than ever.

Examples of private equity invested in the industry include CIC Partners' stake in Red Mango; The Carlyle Group's investment in TCBY (which it sold in July to another PE firm, Z Capital Partners;) Boxwood Capital Partners involvement in Sweet Frog; and Maveron's partnership with Pinkberry, (Starbucks chairman Howard Schultz is the venture capital firm's co-founder.)

(Read more: Can frozen yogurt and ice cream coexist?)

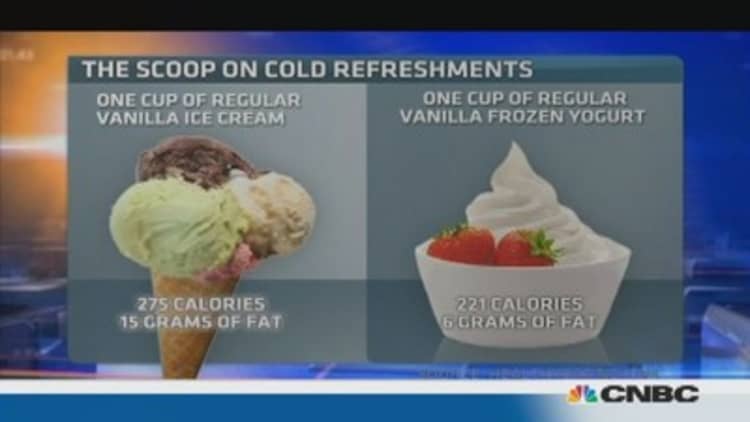

"FroYo"—as the product often is called by fans—has grown in part because customers prefer a healthy alternative to ice cream and other calorie-heavy desserts. People also love the self-serve model, which can save money and calories by controlling portion size.

The biggest frozen-yogurt company today by market share is TCBY—alternatively known as The Country's Best Yogurt and formerly This Can't Be Yogurt—has been around since the early 1980s.

But the craze recently got energized with Pinkberry, which launched in West Hollywood, Calif. in 2005. The FroYo trend—including fresh fruit toppings and tart flavors—quickly caught on in California. Adding to the statewide growth was Irvine-based Yogurtland and South Korean chain Red Mango. Both businesses opened stores in 2006 in Anaheim and Westwood, respectively.

By 2007, there were an estimated 983 frozen-yogurt shop locations in the United States, according to market research firm IBISWorld. Today, there are 1,227 shops in the U.S. spread among 268 companies, according to IBISWorld estimates. Together, the businesses will generate approximately $800 million in revenue this year, employing more than 3,000 people and paying $65.9 million in wages.

Most of the stores are from among the largest FroYo brands: TCBY, Pinkberry, Red Mango, Menchie's, Yogurtland and Orange Leaf Frozen Yogurt.

Stores are most concentrated in California (33 percent of locations,) New York (14.5 percent,) Florida (6.8 percent,) Texas (5.5 percent) and Georgia (3 percent,) according to 2012 IBISWorld research.

Amid the growth, it's unclear if the frozen yogurt trend has peaked.

"There are still growth opportunities within the frozen yogurt stores industry, especially in untapped markets," said Nikoleta Panteva, an IBISWorld industry analyst.

"FroYo establishments first popped up in densely-populated metropolitan areas and in college towns due to the prevalence of health-conscious consumers. However, the trend has caught on nationwide, and establishments are opening up in more suburban neighborhoods as well," Panteva said in an email.

"IBISWorld anticipates the expansion to continue underpinning growth for the industry over the next five years," Panteva said. "Still, the projected revenue increases will be subdued compared to the industry's performance over the past five years because most markets have already been tapped."

(Read more: America's obsession with FroYo)

Reese Travis, chief executive of frozen-yogurt chain Orange Leaf, remains bullish.

"We believe there is a lot of room left in the market for growth. The mom and pop stores and weaker brands will fall to the wayside and we are confident that opportunities will continue to come to Orange Leaf," said Travis, a former employee of hedge fund Wexford Capital. "There are really no scaling constraints, as we have proprietary items that are ready and available for rapid expansion. We see our store count continuing to grow in the U.S. and abroad in the coming years."

Oklahoma City, Okla.-based Orange Leaf launched in 2008 and grew quickly. The franchise had 15 U.S. stores by 2010 and 125 by 2011. Today there are more than 300 stores—including three in Australia. An additional 80 stores are under construction and the company is negotiating deals in Canada and China. Travis projects sales of more than $100 million this year.

Travis is considering taking the company public in 2015 or getting an investment from a private equity firm. "I see (private equity) as a huge positive for the industry and I believe it means that we're investing alongside other smart individuals," said Travis, who owns about 75 percent of his business with his partner, the chairman.

"I am not sure what their (return on investment) is, but those are all great companies and intelligent people making the same investments that we're making," Travis said. "Private equity has always been considered 'smart money' and to be involved in an industry that has attracted the likes of Howard Schultz, I'll put a wager on that bet any day."

—By CNBC's Lawrence Delevingne. Follow him on Twitter @ldelevingne.