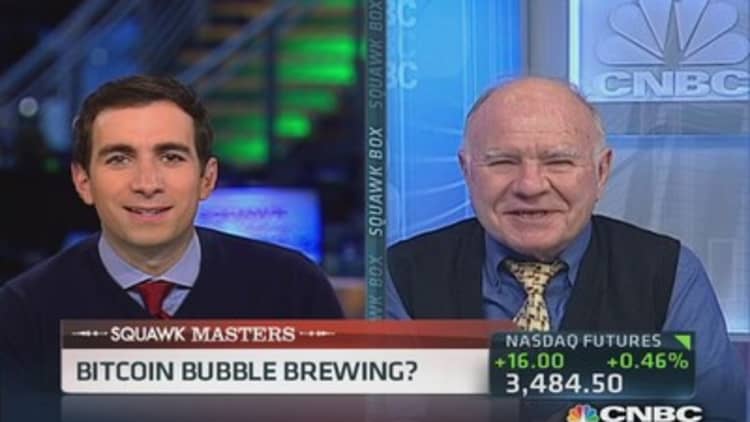

Marc Faber, editor and publisher of The Gloom, Boom & Doom Report, told CNBC on Friday that this week's epic rise of the digital currency bitcoin from $810 to $1200 is a sign of too much money.

"If a symptom of excess liquidity goes into bitcoins, it can go into paintings, farmland, diamonds, all at different times," Faber said on "Squawk Box."

(Read more: Buyer beware: Bitcoin's fate could rest with China)

Faber attributed a "massive speculative bubble" to easy money stimulus policies and called steep rises in assets prices a symptom of the same excess liquidity affecting bitcoin prices.

"I have no idea whether a bitcoin is worth $10,000, a million dollars, or $50," Faber said. "It shows that there is a lot of liquidity that just flushes into one speculative sector of the market to another one."

Bitcoin, the volatile digital currency that this month sparked growing public attention as well as wild fluctuations in price, finished October at a price around $210, according to bitcoin exchange Mt.Gox.com.

(Read more: Faber: 'We are in a massive speculative bubble')

— By CNBC's Jeff Morganteen. Follow him on Twitter at @jmorganteen.