Japan reported a 1.2 percent on-year rise in inflation in November, marking a fresh five-year high.

The November consumer price index (CPI) was above expectations for a 1.1 percent rise in a Reuters poll and up from October's 0.9 percent rise.

Core CPI - excluding food and energy prices - rose 0.6 percent on year in November, its highest level in 15 years.

(Read more: Abenomics scorecard: 'A' for early initiative, 'C' for follow-through)

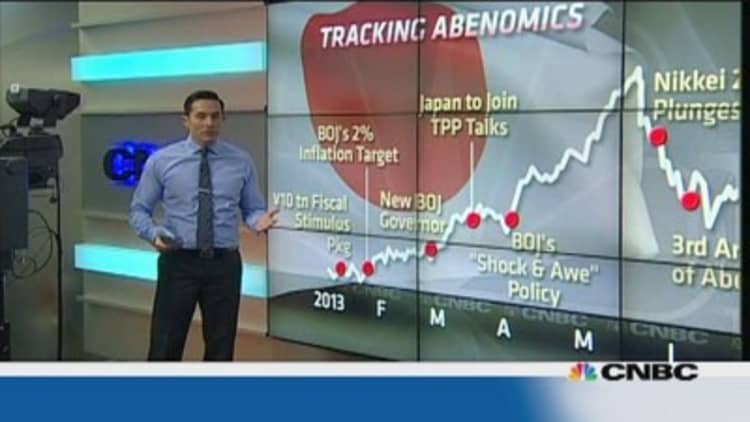

Abenomics – a series of policy measures unveiled under Prime Minister Shinzo Abe in April to jump start the Japanese economy – underlie the rise in inflation.

"It looks like Abenomics is working, according to headline inflation numbers. Now, we have to see whether they have to ease [with] more extreme measures to get it where they want to or can they afford to let it run for a while," said Jesper Bargmann, head of trading, Markets, Singapore at Nordea.

(Read more: Verdict on Abenomics, one year on)

"The whole market is buying into Abenomics so of course, if inflation starts picking up quicker than expected, then yes it's a success but it could also mean that they might not have to go as extreme as the market expected," he added.

Friday's figures bring the Bank of Japan closer to reaching its target of 2 percent inflation in two years. The reading comes hot on the heels of comments from Bank of Japan Governor Haruhiko Kuroda on Wednesday that Japan's consumer inflation is likely to exceed 1 percent in the first half of 2014 and will help heighten inflation expectations.

For the Tokyo area, Japan reported a 0.7 percent on-year rise in core CPI for the month of December, in line with expectations.

Japan also posted retail sales and industrial output data on Friday.

Retail sales rose 4.0 percent on year in November, well above expectations for a 2.9 percent rise in a Reuters poll and marking their fastest pace since April 2012.

The data underpinned a pick up in private spending ahead of a national sales tax hike due to take effect in April, which will see the sales tax rise to 8 percent from 5 percent currently.

Industrial output rose 0.1 percent on month in November, below expectations for a 0.4 percent rise.

According to the Japanese Ministry of Economy, Trade and Industry (METI), Japanese manufacturers see output at 2.8 percent on month in December, up from the previous forecast of 2.1 percent. For January, manufacturers see output at 4.6 percent on month.

Following the data the yen fell to a fresh five-year low of 104.93 per dollar. The Nikkei 225 rose 0.3 percent to a fresh six-year high in early trading, extending its rise above the 16,000 level.