The National Football League is embroiled in drama over the Ray Rice domestic violence scandal, with some voices calling for Commissioner Roger Goodell to be fired. The controversy overall has stirred curiosity about how the NFL is run, and how it makes money.

In fact, the NFL is actually tax-exempt, a status it gained in 1944. Often forgotten, the league was granted 501(c) 6 status in 1966, when it merged with the American Football League. But unlike charitable nonprofits, or 501 (c) 3 organizations, the 501(c) 6 designation means the NFL is a trade organization. This tax-exempt status does not apply to the league's 32 individually owned franchises. The U.S. Chamber of Commerce is also a 501 (c) 6 organization.

Read MoreNFL toughens penalties for domestic violence

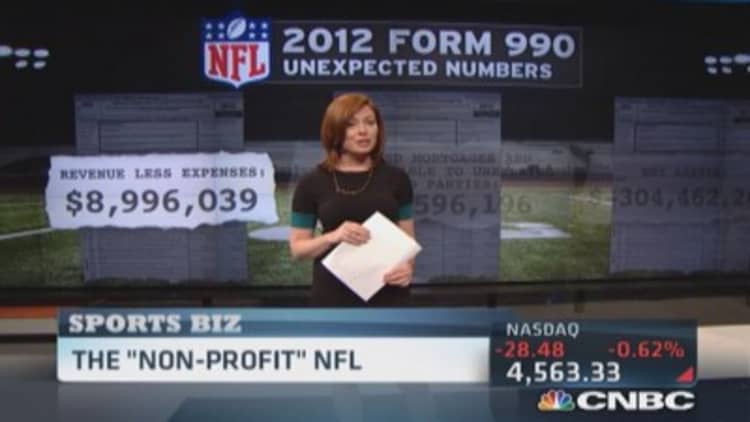

The league's form 990 from 2012, the latest available filing, shows some unexpected NFL figures.

Football in America makes about $10 billion annually. The NFL actually wound up in the red for $304,462,262 that year. That same year, Goodell made more than $44 million.

The money generated by sponsorships, broadcast deals and ticket sales is taxed through a for-profit organization owned by the 32 franchises or teams, called NFL Ventures.

Real estate

The league is also investing in real estate, according to the 990. The NFL had $833,596,196 in secured mortgages and notes payable to unrelated third parties in 2012.

Finally, the league had nearly $9 million in revenue-less expenses that year.

The NFL tells CNBC.com the mortgage line does not reflect direct real estate investments, but rather loans for its club members as a part of the league's G-3 program.

"The amount on the 990 reflects funds that the NFL has borrowed from third-party lenders and that it then lends to its clubs to enable them to build new stadiums in public/private partnerships," Jeremy Spector, partner at Covington & Burling and the league's outside tax counsel, stated in an email message.

Read MoreHow the NFL makes the most money of any pro sport

Even though it looks like the NFL is losing tons of cash, the league is not "functionally underwater," said Fran Hill, professor of Law and the Dean's Distinguished Scholar for the Profession at the University of Miami School of Law. Form 990s are often just a snapshot in time.

"The mortgages are not a problem—a nonprofit can have mortgages, which are at the moment in excess of the current value of the property," Hill says. "I would imagine the Chamber of Commerce's 990 looks similar. They can be conducting business at this level, and in this way, legally."

Licensing and royalties

Hill, however, did notice one interesting detail in the NFL's 990 filing.

"Most of their income comes from licensing and royalties, which are not subject to the unrelated business tax," she says. "The form 990 tells us they are spending huge amounts of money, and making huge amounts of money."

But if Senator Tom Coburn, R-Okla., gets his way—the NFL won't be reaping the benefits of being a nonprofit for much longer.

Coburn is leading the charge to reform what he views as a loophole, introducing in 2013 the "PRO Sports Act," repealing tax-exempt status for certain professional sports leagues after 2013. Thus far, the bill has not yet moved forward.

Coburn's argument is the league is not benefitting football overall, as trade associations are supposed to—but is instead profiting for itself.

"Taxpayers are losing $10 million a year subsidizing these tax loopholes for professional sports leagues that generate billions of dollars annually in profits," Sen. Coburn told CNBC in a written statement.

The National Hockey League and the Professional Golfers Association are among other sports groups that enjoy tax-exempt status as a trade organization.

Along with Senator Angus King, R-Maine, "I have introduced legislation to ban major professional sports leagues from qualifying as non-profits under the tax code," Coburn said in the email. "Major leagues shouldn't be scoring touchdowns and shooting eagles on the backs of taxpayers by getting to claim tax-exempt status."

Read MoreWhy Main Street isn't creating jobs