The ongoing drama surrounding Greece's efforts to drum up support for a new debt deal is just "theater," according to one analyst, who warned that Europe needs to wake up.

Greek Finance Minister Yanis Varoufakis met his German counterpart Wolfgang Scheuble in Berlin on Thursday, after a week of travelling across Europe to try and bolster support for a new debt deal and bailout conditions. The talks were a mixed success, however, with Scheuble saying that the ministers had "agreed to disagree," but Varoufakis denying that this was the case.

Satyajit Das, author of "Traders, Guns & Money: Knowns and Unknowns in the Dazzling World of Derivatives," told CNBC Friday that the talks were symptomatic of a "make-believe world."

"Everyone wants to live in fairyland and none of us want to go back to real economies," he said. "This is nice theater, but it's not going to solve anything."

With no apparent progress over a debt deal for Greece, despite a week of high profile meetings between Varoufakis and Greek Prime Minister Alexis Tsipras and their fellow euro zone ministers, there is growing speculation over the eventual outcome.

Read MoreMarkets hit as ECB plays hardball with Greece

Das, an expert on financial derivatives and risk management, went on to stress that Greece's "underlying dynamics" hadn't changed.

"They still can't pay back their debt and we haven't fixed anything. We still have to fix the basic economy," he said. "The fundamental thing is that the Greeks want to be in the euro, they want to get this relief. The Germans want to save the German banks and the French want to save the French banks -- they don't want to have write-offs."

Backtrack?

The media has been following Greece's new government closely this week, with investors eyeing whether the country can persuade Europe to agree to restructure its massive debt pile. For its part, Greece dropped calls for a debt haircut earlier this week, appearing to backtrack from the more extreme anti-austerity rhetoric it used when it first came to power less than two weeks ago.

Adding to the drama was the European Central Bank's (ECB) decision to revoke a waiver that allowed banks to use Greek government debt as collateral for loans, saying it was no longer able to assume there would be a successful conclusion to the Greek government's bailout program review.

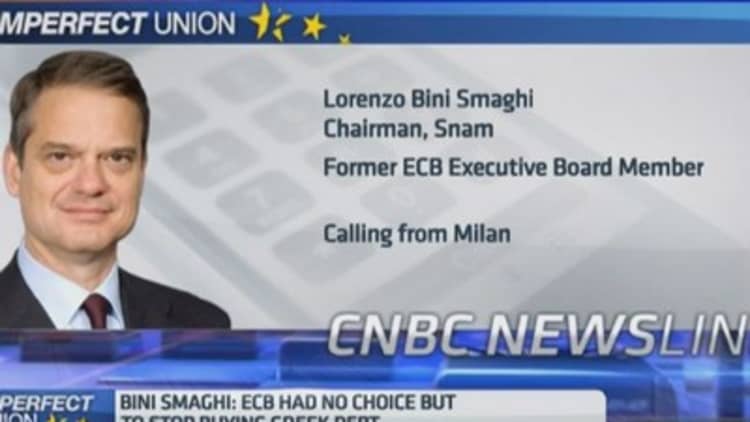

Lorenzo Bini Smaghi, a former ECB executive board member, told CNBC Friday that the ECB "could not do otherwise" and that once Greece decided to continue with its bailout program, its banks would become eligible for ECB funding again.

He added that whether Greece faced a capital flight risk depended on how worried Greek citizens felt about the negotiations.

Das warned that everyone was getting "terribly excited" about the Greek saga and needed to "have some valium" and calm down.

Read MoreCrunch time:Compromise on the cards for Greece?

"You have the ECB is playing the enforcer, (German Finance Minister) Wolfgang Scheuble being the hard man, the French being nice to the Greeks, the Spanish being stand-offish – it's all theater. Basically everybody has to play to their political constituencies," he told CNBC Europe's "Squawk Box."

"We all know there is no answer. Reducing the amount of debt in terms of write-offs is not going to help."

High stakes

The Greek saga could be viewed as farcical -- if only the stakes weren't so high. The Greek government is under pressure to find a solution to its funding situation, as its bailout program is due to end in February and there is still a tranche of funding it has not yet received.

The country's international creditors have refused to release the funds until Greece makes a commitment to continue with the conditions of its bailout – which include tough austerity measures -- meaning that Tsipras has to choose between angering Greek voters by reversing pledges, or lose access to vital funding.

The decision will also have a market impact. Greece's borrowing costs leapt and its financial stocks tanked on Thursday after the ECB's said that banks couldn't use the country's debt as collateral late Wednesday.

Panicos Demetriades, former governor of the Central Bank of Cyprus, told CNBC Friday that a "game of chicken" was being played out between the Greeks and Germans. And he added that an agreement over Greece was needed sooner rather than later in order to maintain confidence in the Greek financial system.

"The Greeks have done everything possible to gain support for their positions, which are not unreasonable as the program doesn't seem to be producing what was expected of it," he told CNBC Europe's "Squawk Box."

"But they really don't have the time that they think they do -- that time isn't there."

Demetriades, who is currently a professor of financial economics at the University of Leicester in Britain, said that the ECB move was a symptom of deposit outflows in Greece.

"Depositors are getting nervous. Even a small chance of the euro area breaking up would leave them in a mess," he said. "It is important that the Greek government understands that if there is no agreement soon things will progressively get worse for them."

- By CNBC's Holly Ellyatt, follow her on Twitter @HollyEllyatt. Follow us on Twitter: @CNBCWorld