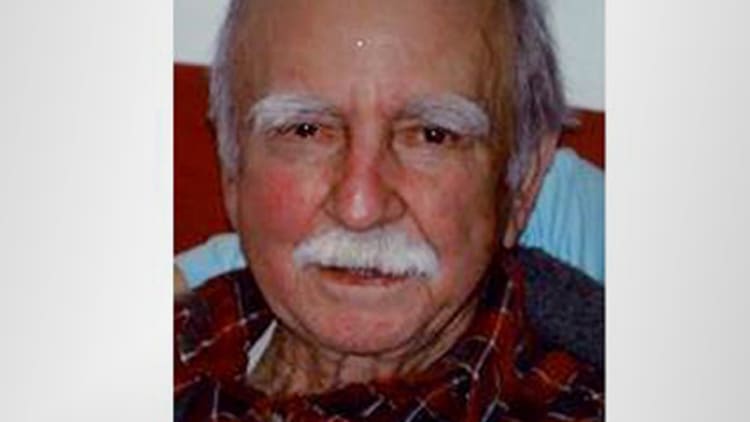

Ronald Read, a Vermont gas station attendant and janitor, invested in recognizable names when he amassed an $8 million fortune, according to his attorney. A large part of that fortune was later bequeathed to an area library and hospital after his death, stunning a community that had no idea about his wealth.

Most of Read's investments were found in a safe deposit box, Read's attorney, Laurie Rowell, told CNBC. Those investments included AT&T, Bank of America, CVS, Deere, GE and General Motors.

"He only invested in what he knew and what paid dividends. That was important to him," she said in an interview with "Closing Bell."

Read, who died at 92, has been described as quiet and frugal. No one appeared to have any idea that he was so wealthy, including his stepchildren, Rowell said.

Read MoreJanitor bequeaths millions to library, hospital

Financial expert Chris Hogan, a strategist with Ramsey Solutions, applauded Read's diligence and believes others can follow his example.

"It's a matter of living a certain way, keeping your lifestyle under control and being committed," he said.

For example, to reach Read's $8 million fortune, Hogan calculated that investors would have to invest about $300 a month at an 8 percent interest rate over 65 years.

He said people need to identify how much they want to save, how much they want to give away and figure out how to get there by sitting down with an investment professional, "someone that has the heart of a teacher, not someone trying to sell you stuff."

"It can be done. In America we need to start believing back in the American dream and stop buying the stuff that's on commercials," he said.

Read MoreTech tycoons top list of givers

However, Diane Garnick founder and CEO of Clear Alternatives, cautioned that the environment these days is much different than when Read invested. She noted that he likely saved cash in the '70s before moving into the stock market, and then caught the tech boom. On top of that, interest rates are literally at zero, she noted.

"One of the things that's really important is for us to take a step back and say look it's great that that happened over the last 40 years but there is a lower probability that it happens over the next 40 years," she said.

—Reuters contributed to this report.